Bharat Heavy Electricals Ltd (NSE: BHEL) shares took a breather on Tuesday after an early spike, slipping 0.9% intraday to ₹263.70 as traders booked profits following a high-profile contract win. The counter had rallied sharply after the company secured a ₹6,500 crore thermal power equipment order from Adani Power, one of its biggest project wins in recent quarters.

The stock opened on a strong note at ₹267.75, touching the day’s high before gradually losing steam. By midday, BHEL was trading near its session low of ₹263, with visible pressure on the order book. Sell volumes overtook buy demand, with nearly 23.5 lakh shares on offer against 9.3 lakh in demand.

It’s a sign that traders may have already priced in the positive announcement and are now rotating out to lock in gains.

What’s Fueling the BHEL Buzz?

BHEL’s latest boost comes from a major ₹6,500 crore contract awarded by Adani Power. The deal covers the supply and construction of six thermal power units, each packing 800 MW, a massive addition to the company’s project portfolio. It’s a big win that reinforces BHEL’s place in India’s power equipment space.

The timing couldn’t be better. As India ramps up investments in energy infrastructure, BHEL’s consistent order inflow from both government and private players. Positions it as a strong play on the country’s long-term power ambitions.

BHEL Chart Analysis Today

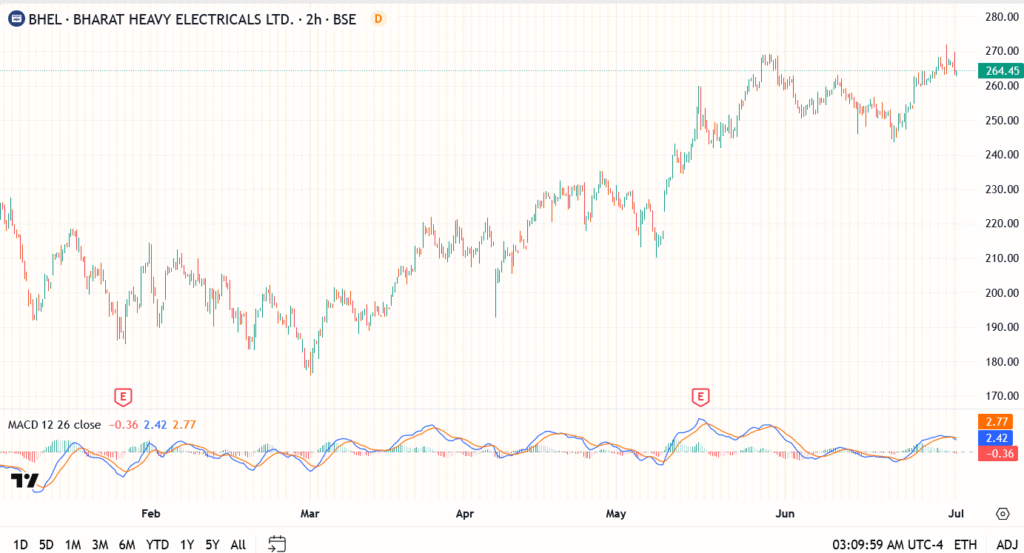

- Current price: ₹264.45

- Resistance: ₹270, then ₹285

- Support: ₹255, then ₹240

- MACD: Bullish crossover fading, momentum slowing but still positive

BHEL stock is trading roughly 21% off its yearly peak. With a market cap north of ₹91,000 crore, the company remains one of India’s most valuable names in the industrial engineering space.

Outlook Ahead

Tuesday’s pause doesn’t change the structural story. With the Adani Power order in hand and execution visibility improving, BHEL may still have room to run, especially if fresh government spending or infrastructure policy support flows in ahead of the Union Budget.

For now, short-term traders might stay cautious, but long-term investors will be watching for earnings delivery and margin clarity in upcoming quarters.