- Crude oil prices fall after Reuters quoted two insider sources in Saudi Arabia's oil operations as saying that facilities could be online in 2-3 weeks.

Crude oil prices are falling in New York trading as hopes rise for quick restoration Saudi lost oil output. A Reuters news report which has just crossed the newswires, has quoted two sources with information on the matter as saying that the oil output of Saudi Arabia, which was cut in half by the weekend drone attacks, would be restored fully in 2-3 weeks.

“Saudi Arabia is close to restoring 70% of the 5.7 million barrels per day of oil output loss…the impact on Saudi Arabian oil exports has been minimal during the crisis thanks to storage,” according to the Reuters report quoting the insider sources.

If this eventually turns out to be the case, this would be a best case scenario as it would represent a faster recovery time than was initially feared.

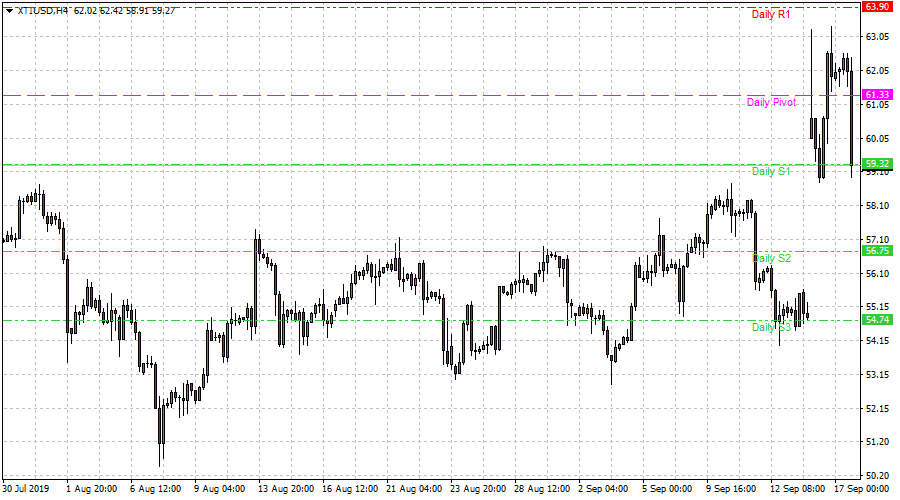

This report has sparked an immediate market reaction in crude oil prices, with WTI crude oil currently trading at $59.52, after falling 3.4% from today’s intraday highs of $62.56. Crude is presently testing intraday S1 support pivot at $59.32. A drop below $59 will open the pathway for a test of $58.25 and below this level, $556.75 (highs of August 21 and 30 in role reversal). A failure of the break attempt at $59.32 reopens the door once more to $61.33 (central pivot) in the near term.

The Saudi Energy Minister is expected to commence his press conference in just under 3 hours from now.