- Crude oil price on the Brent crude benchmark declines on the day despite a shortfall in crude oil stocks, as the market is hit by risk aversion.

Crude oil prices on the Brent benchmark have fallen to fresh weekly lows despite the EIA crude oil inventories report that indicated that there was a 9.4 million barrel shortfall in oil stocks in the week ended August 28. Price is not challenging the lower barrier of the range formed by price action in the last three weeks.

Hurricane Laura largely spared major oil facilities in the Gulf Coast, which provided a limitation to further bullish action on crude oil benchmarks. Today’s bearish action on crude oil prices stems from USD strength, brought on by a tinge of risk aversion. Other risky assets such as the Aussie Dollar and copper are also facing stiff opposition to the upside.

Intraday selling around Brent crude oil has picked up pace and is sending the asset towards lows for the week. Brent crude is currently trading at 44.68 or 2.36% lower on the day.

Technical Outlook for Brent Crude

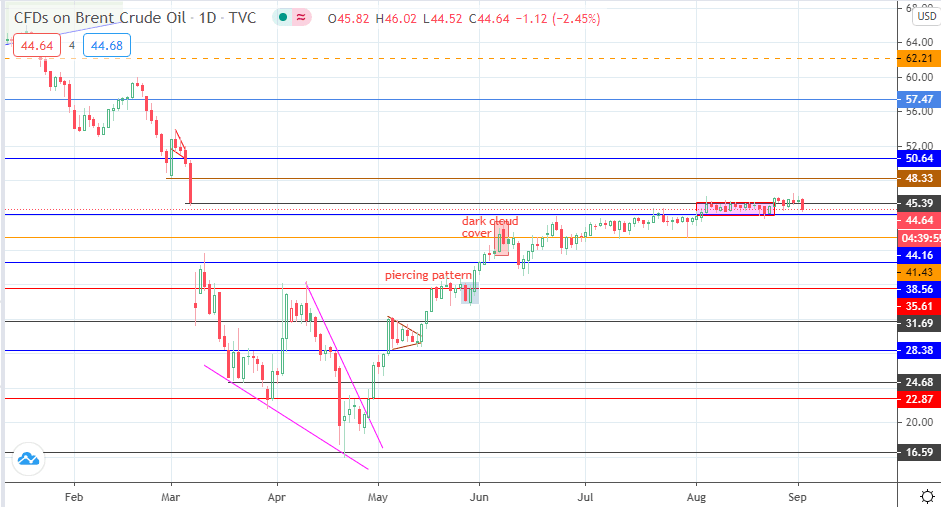

The bearish action has allowed Brent crude to hop back into the range which had 45.39 as the ceiling and 44.16 as the floor. The market momentum is with the bears and enhances the prospect of the range floor to come under pressure. A breakdown of this floor opens the door for bears to target the 41.43 support in the near-term, with 38.56 and 35.61 remaining as relevant targets to the south on greater decline.

On the flip side, a breakout above the ceiling changes the sentiment and creates a pathway towards 48.33. However, this move has to be accompanied with greater conviction by the bulls. 50.64 is an additional resistance target, but looks a bit far-fetched at the moment.