- Silver has surged roughly 170% over the past 12 months, massively outperforming most commodities as prices climbed from the low-$30s to record highs above $94 in January 2026.

- Safe-haven demand and geopolitical risk are driving the rally, with U.S.–Europe trade tensions, tariff threats linked to Greenland, and broader policy uncertainty pushing investors toward precious metals.

Silver prices surged to fresh all-time highs during the Asian session on Tuesday, January 20, 2026, with XAG/USD breaking above $95 per ounce for the first time on record. The rally accelerated overnight as safe-haven demand intensified, following renewed geopolitical tension tied to U.S.–Europe trade threats over Greenland and a broader flight out of risk assets.

Spot silver pushed sharply higher from the $92–$93 zone late Monday, extending gains into early Asia before stabilising near $95.30–$95.40 during the European morning. The move mirrors a wider precious-metals surge, with gold also holding near record highs as investors hedge against trade disruption, political uncertainty, and a softer U.S. dollar.

Gold has also rallied to record highs above $4,700, reinforcing the broader safe-haven trade. However, silver has clearly outperformed, attracting both defensive flows and speculative interest as traders look for higher beta exposure within the precious metals complex.

Silver has surged roughly 200–207% in the past 12 months, based on historical XAG/USD price data showing silver trading around the mid-$20s to high-$20s range a year ago vs near $95 now, representing a more than two-fold increase year-over-year.

Why Are Silver Prices Rising Today?

- Safe-haven demand is surging: Heightened geopolitical risk, including renewed US–Europe trade tensions linked to Greenland, has pushed investors toward precious metals as protection against uncertainty.

- Gold’s breakout is pulling silver higher: Gold trading at record highs above $4,700 has reinforced bullish sentiment across the precious metals complex, with silver outperforming due to its higher beta.

- Tight physical supply conditions: Inventory drawdowns and limited near-term mine supply have amplified price moves as demand accelerates faster than available supply.

- Strong industrial demand narrative: Silver continues to benefit from its role in solar panels, EVs, electronics, and data infrastructure, keeping structural demand elevated even at higher prices.

- Momentum and speculative flows: A confirmed breakout above the $90–$92 zone triggered stop-losses and trend-following buying, accelerating the rally toward new all-time highs.

- Weaker US dollar backdrop: The US Dollar Index trading below recent highs has made dollar-denominated silver more attractive to global buyers, adding fuel to the move.

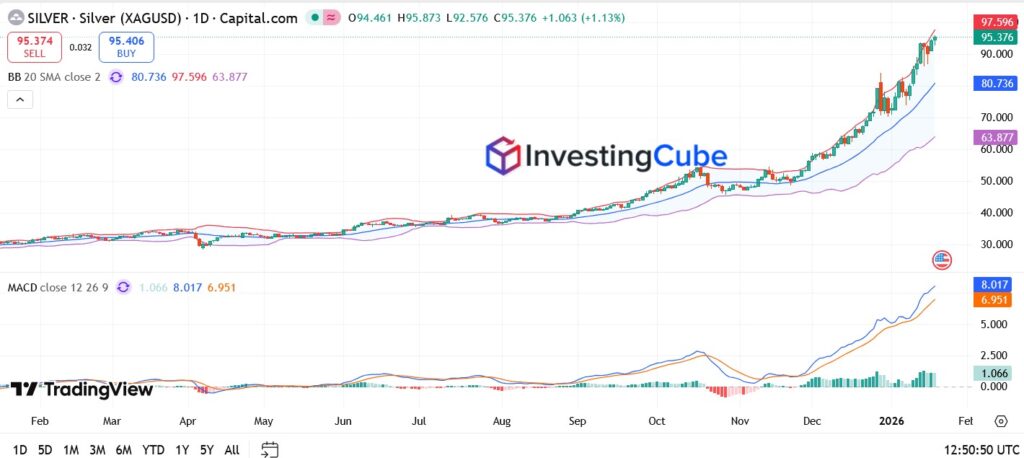

Silver (XAG/USD) Daily Chart Analysis

Based on the daily chart:

- Trend: Silver remains in a steep and well-defined bullish trend, with price trading far above all major moving averages.

- Breakout: The decisive break above the $90–$92 psychological zone confirms a major upside continuation rather than a short-term spike.

- Silver Support levels:

- Initial support sits near $92.00–$93.00, the former breakout zone.

- Deeper pullbacks could find buyers near $90.00.

- Silver Resistance levels:

- Near-term psychological resistance is now in focus at $100 per ounce.

Can Silver Prices Reach $100 Next?

With silver now firmly above $95, the $100 level has become the dominant psychological target. Round numbers matter in momentum-driven markets, and $100 is likely to attract both trend followers and profit-taking activity.

A push toward $100 remains achievable if geopolitical tensions persist, the U.S. dollar stays under pressure, and risk appetite remains fragile. However, given the speed of the rally, traders should expect periods of consolidation or sharp but shallow pullbacks along the way.

For now, there are few technical signs of distribution. As long as silver holds above the $92–$93 zone, the broader bullish structure remains intact.

After such a rapid rally, short-term corrections or consolidation phases are possible, especially if profit-taking emerges. However, as long as silver holds above key breakout zones, pullbacks are widely viewed as corrective rather than trend-reversing.

Silver is outperforming gold due to its dual role as both a safe-haven asset and an industrial metal. Strong demand from solar energy, EVs, data centers, and electrification, combined with geopolitical risk and momentum inflows, has amplified silver’s upside more aggressively than gold.

Despite trading at all-time highs, many investors continue to view silver as attractive due to tight supply conditions and long-term structural demand. New buyers are increasingly focusing on pullbacks or ETF exposure rather than chasing spot prices, while long-term holders remain positioned for further upside into 2026.