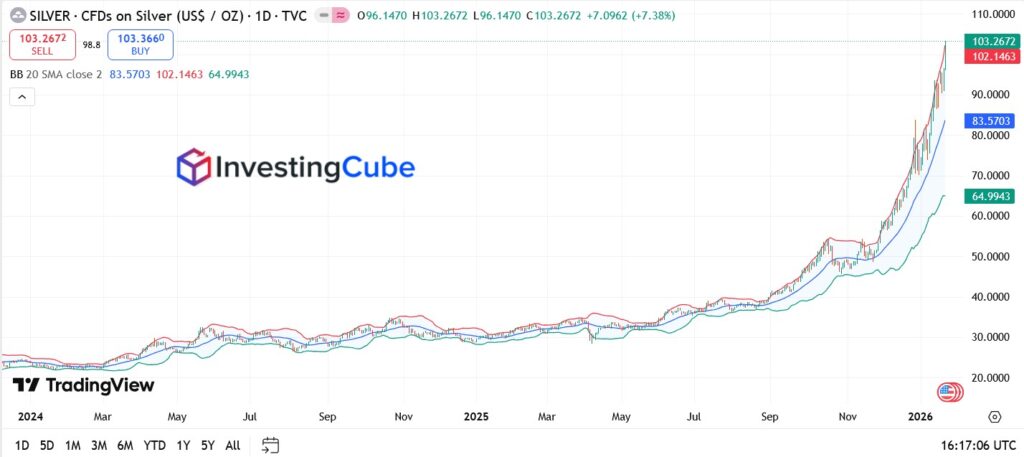

Silver prices have entered a historic phase after breaking above $100 an ounce for the first time. As of writing, spot silver is trading around $103 per ounce, extending one of the strongest rallies in the metal’s modern trading history. The move caps a blistering run that has seen silver gain more than 40% year-to-date, following a year in which prices more than doubled in 2025, pushing the market firmly into price-discovery territory.

Silver Breaks $100 as Momentum Accelerates Into 2026

The current silver rally is no longer incremental. It is parabolic.

On the daily chart, silver has accelerated sharply above its upper Bollinger Band, confirming a momentum breakout rather than a slow grind higher. The move above $100 has come alongside expanding volatility, rising volume, and aggressive dip-buying, all hallmarks of a late-cycle acceleration phase.

Silver’s breakout is also happening in lockstep with gold, which is trading just below the psychological $5,000 level. Historically, when gold enters price discovery, silver tends to outperform on a percentage basis, a dynamic already visible in early 2026.

JPMorgan Short Squeeze: Why Silver Bulls Are Targeting $400–$500

One of the most talked-about drivers behind silver’s surge is the renewed focus on concentrated short positioning, particularly linked to large bullion banks.

At the Vancouver VRIC conference, investor Willem Middelkoop argued that silver may finally be entering a phase where structural shorts are being forced to unwind. He suggested that under a true short-squeeze scenario, silver prices could surge toward $400–$500, potentially as soon as the second half of 2026.

This view aligns with recent data showing silver short positions at their lowest levels since late 2023, a setup that increases price sensitivity during periods of heavy inflows and thin liquidity.

While not a forecast consensus, the return of the JPMorgan short squeeze narrative reflects growing stress in the physical silver market, particularly as investment demand accelerates.

Physical Silver Demand Surges as Retail Buying Explodes From China to the US

Beyond futures positioning, the silver rally is being reinforced by explosive physical demand, especially in Asia.

In China, silver investment products are now experiencing shortages as reported by FX Leaders. Manufacturers that previously focused on jewelry production have shifted almost entirely toward investment-grade silver bars, with factories running overtime to meet demand. Retail buyers are increasingly purchasing 1-kilogram, 500-gram, and even 100-gram bars, signalling broad participation rather than niche speculation.

This surge in physical demand mirrors patterns seen during previous precious metals supercycles, where retail accumulation amplified price momentum well beyond what paper markets alone could sustain.

Why Silver Is Outperforming Gold in This Phase

Silver’s dual role as both a monetary metal and industrial input gives it unique leverage during periods of macro stress and capital rotation.

While gold remains the primary store of value, silver benefits from:

- Safe-haven inflows during geopolitical uncertainty

- Inflation hedging alongside gold

- Industrial demand linked to energy transition and electronics

- Higher volatility, which attracts speculative capital

The falling gold-to-silver ratio reinforces this dynamic. Historically, when silver begins to lead gold, it signals broad strength across the precious metals complex, not a short-lived spike.

Silver Technical Outlook: Key Levels to Watch

From a technical perspective, silver has entered uncharted territory, making traditional resistance levels less relevant.

Key levels now include:

- Psychological resistance: $110, $125

- Momentum extension zone: $150–$180

- Long-term bullish projections: $300–$500 under extreme squeeze conditions

On the downside, former resistance at $90–$95 now acts as first major support. As long as silver holds above this zone, the broader bullish structure remains intact.

Outlook: Is $500 Silver Realistic by End-2026?

A move to $500 silver would require multiple forces aligning simultaneously, including:

- Sustained gold strength above $5,000

- Continued physical shortages

- Further unwinding of concentrated short positions

- Strong retail participation without aggressive policy suppression

While $500 is not a base-case forecast, it is no longer a fringe scenario. The current rally has shifted silver from a slow-moving commodity into a high-beta monetary asset, where price discovery can unfold far faster than traditional models assume.

Volatility will remain extreme. Pullbacks are inevitable. But structurally, silver has entered a regime change.

Analysts warn that at $103, Silver is “violently overbought.” They suggest that while the long-term trend is up, a “healthy” correction of 30%–50% (potentially back to $70–$80) could happen in Q1 before the next leg up

Silver is outperforming gold in 2026 because it is benefiting from a rare combination of safe-haven demand, industrial scarcity, and speculative momentum. Tight physical supply, strong industrial usage in energy and electronics, and heavy retail buying, especially from China and the US, have amplified price moves.

No, manufacturers are unlikely to stop using silver even above $100 per ounce.

Historically, high prices lead to thrifting rather than substitution, meaning manufacturers use less silver per unit instead of replacing it. In 2026, this effect is limited because there is no viable substitute for silver’s conductivity in high-efficiency solar panels, EV components, and advanced AI semiconductors.

While jewelry demand is weakening at current prices, industrial buyers are in panic-buy mode to secure supply, which is reinforcing, not reducing, silver demand.