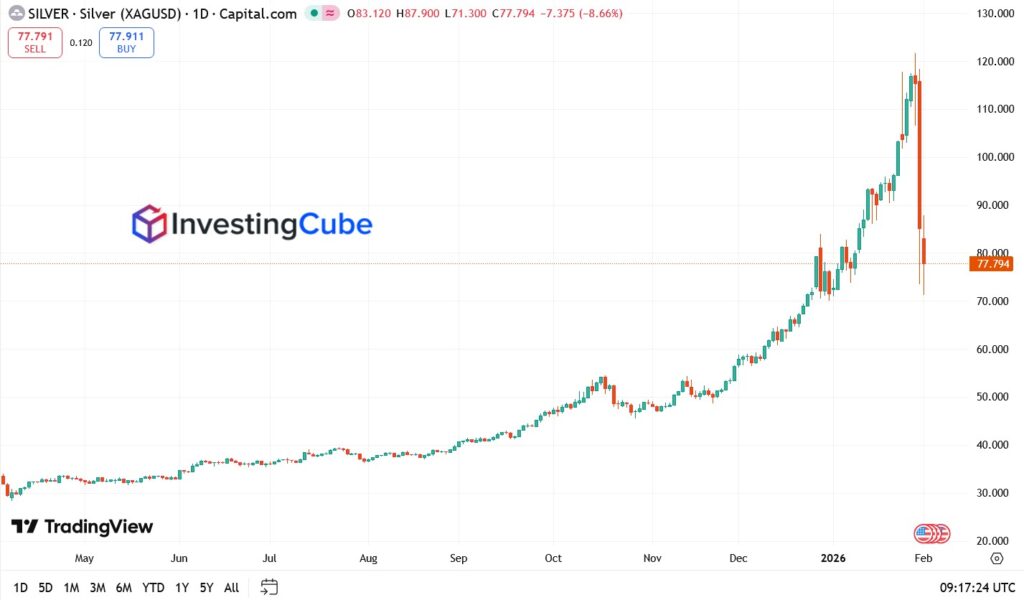

- Silver Price Collapse: Silver has plunged from a January high near $121 to the $78 area, marking a rare 35% two-day decline driven by forced selling.

- Fed Policy Shock: The nomination of Kevin Warsh as the next Federal Reserve Chair has strengthened the US dollar and reversed the liquidity conditions that fueled silver’s rally.

- Margin Pressure: CME margin hikes accelerated liquidation across leveraged silver positions, amplifying downside momentum.

Silver is trading at $78.67 on the Monday London session after a 35% crash from its record peak last Thursday. The move from $121.00 to $78.67 is not merely a technical correction; it is a structural “reset” of the precious metals market. The primary driver is the “Warsh Factor.”

Market participants view Kevin Warsh as a monetary hawk likely to prioritize balance sheet discipline and inflation control over open-ended liquidity. This shift in Fed leadership expectations has caused US Treasury yields to surge, making the non-yielding Silver less attractive.

Additionally, as reported by Yahoo Finance, the Shenzhen Stock Exchange implemented emergency trading halts for silver-linked funds, trapping Chinese speculators and forcing them to dump international holdings to raise cash.

Silver Margin Calls Spark Disorderly Market Selloff

The speed of silver’s collapse was amplified by a sharp squeeze on leveraged positions. Late last week, the CME Group announced a series of aggressive margin hikes for silver futures, forcing traders to post significantly higher collateral in a very short window.

The sudden increase triggered a classic liquidation trap. As prices fell, margin calls intensified, pushing traders to sell into weakness rather than wait for stabilization. What might have been a deep correction quickly turned disorderly as forced selling fed on itself.

Unlike gold, which has managed a comparatively controlled pullback above the $4,400 area, silver’s high-beta nature left it exposed. Heavy speculative positioning, particularly from retail and momentum-driven accounts earlier in January, evaporated rapidly, leaving thin liquidity and few natural buyers near the $79 level.

Gold Crashes $1,000 but Silver Takes the Hit

Gold has plunged more than $1,000 in just two sessions, one of the sharpest drawdowns on record. Even so, silver has absorbed far more damage, reflecting how violently speculative positioning has unwound across precious metals.

Gold’s fall has been driven by broad liquidation and dollar strength, but structural demand from central banks and long-term hedgers has helped slow the decline. Silver, by contrast, entered the selloff heavily leveraged, leaving it exposed once margin pressure hit.

Silver Technical Outlook: Key Levels After the Crash

From a technical perspective, silver is now in a price discovery phase following the breakdown of prior support zones.

- Immediate Support: The $78–$80 area is acting as near-term stabilization territory.

- Downside Risk: A sustained break below $78 could expose the market to a test of the $75 psychological level.

- Resistance: Any rebound is likely to face selling pressure near $85 and again around $100, where prior momentum peaked.

Momentum indicators suggest the market is oversold, but volatility remains elevated, limiting confidence in short-term rebounds.

Conclusion: A New Era for Precious Metals?

The Silver price forecast has shifted from a “moonshot” narrative to one of survival. The combination of a hawkish Federal Reserve nominee and regulatory intervention in China has successfully punctured the speculative bubble. Investors should now look toward the Bank of England and RBA decisions later this week to see if other central banks follow the Fed’s lead in tightening the liquidity taps.

Silver FAQs

Silver is often described as “Gold on steroids” due to its higher volatility and lower liquidity. While Gold has retracted approximately 16% from its peak, Silver’s 35% crash reflects the higher concentration of speculative leverage and the impact of the CME margin hikes.

It refers to the nomination of Kevin Warsh as Fed Chair. His reputation for fiscal hawkishness has strengthened the US Dollar and pushed bond yields higher, both of which are traditionally “poison” for non-yielding assets like Silver.

The long-term outlook remains constructive, but the short-term trend has reset. Silver needs time to stabilize before any sustainable recovery can develop.