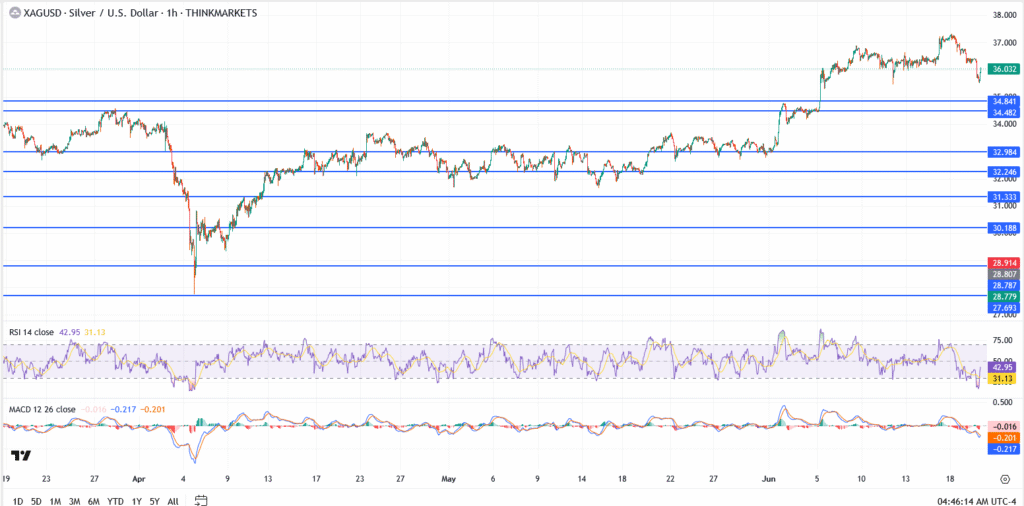

Silver prices tumbled on Friday, falling below the $36.00 handle after hitting a fresh 13-year high earlier this month. At the time of writing, XAG/USD is trading at $36.03, down around 2.5% from this week’s swing peak.

The pullback comes as investors reassess safe-haven positioning amid escalating geopolitical tensions in the Middle East and a firmer U.S. dollar. While silver had surged on safe-haven demand in May and early June, traders are now locking in profits, especially after the metal struggled to hold above the $37.50 resistance zone.

What Caused Silvers Rally?

Silver’s rally was largely driven by a mix of war concerns, ETF accumulation, and momentum spillovers from gold. But with the Federal Reserve holding interest rates steady and signaling fewer cuts this year, the dollar has caught a bid and that’s capped silver’s upside.

Oil and bond markets also remain volatile, adding cross-asset pressure to metals. Meanwhile, profit-taking was likely triggered by technical exhaustion, as the RSI peaked above 75 last week and spot prices printed a clean double top.

XAG/USD Technical Outlook Today

- Current price: $36.03

- Immediate resistance: $36.70

- Key resistance: $37.80 (13-year high)

- Support zones: $34.84, then $34.48

Conclusion

Silver may have hit a short-term ceiling, but the broader uptrend remains intact unless the metal breaks below $34.48 on volume. For now, bulls appear to be taking a breather, not abandoning ship. If volatility picks up again next week, expect renewed interest in silver as a geopolitical hedge.