Why has gold been so quiet this week?

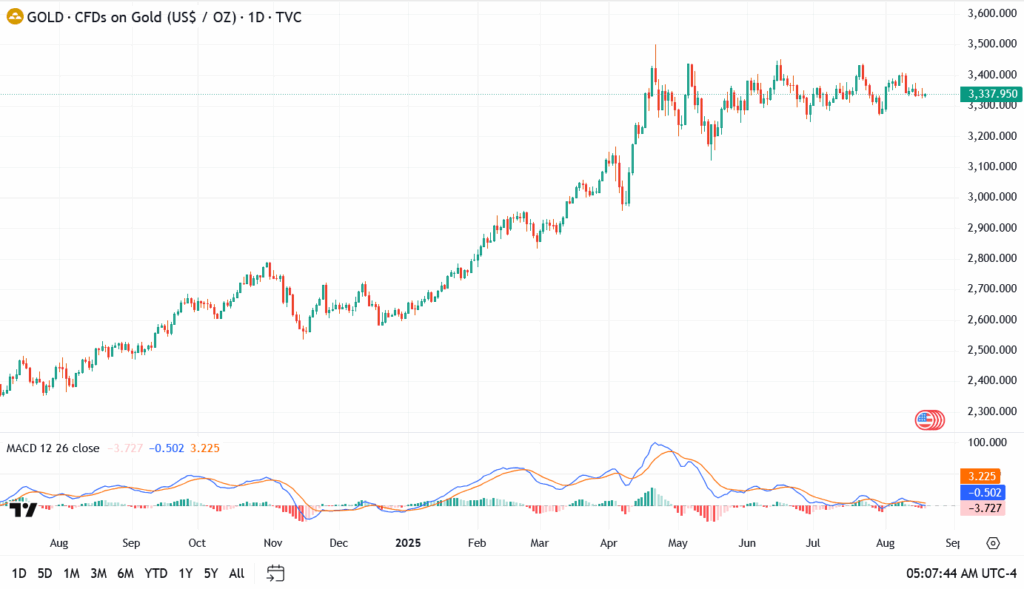

Gold spent Tuesday morning hovering near $3,335-$3,345 after a stop-start Monday, with buyers defending the $3,300 handle while momentum faded under $3,400. The tape looks like a truce. US yields are firm, the dollar has a mild bid, and safe-haven flows are softer as headline risk cools. At the same time, no one wants to dump metal ahead of fresh Fed clues and late-month event risk. ETF flows have slowed, not collapsed, and central bank demand is still a steady undercurrent. Net result is a tight range near the upper third of this year’s channel, a market waiting for a reason to move.

What are today’s key gold levels?

- Current price: $3,340

- Immediate resistance: $3,400, then $3,480

- Support zone: $3,300, then $3,250

- Momentum read: MACD is flat, RSI mid-range, confirming consolidation

Price keeps pinging between $3,300 and $3,400. A daily close above $3,400 would wake up trend followers and put $3,480 back in play. Lose $3,300 on a closing basis and the market likely checks $3,250. Break that and $3,180 becomes the next magnet.

Could the Fed reset the gold narrative this week?

Yes. Traders have trimmed aggressive rate-cut bets, which props up real yields and caps rallies in non-yielding assets like gold. If upcoming Fed communication leans patient, gold stays range-bound or slips toward $3,300. Any hint of softer growth or a gentler policy path would flip the script and invite a squeeze through $3,400.

In other news: Hong Kong eyes global gold hub status

Hong Kong’s Financial Secretary Paul Chan confirmed the city plans to roll out a blueprint for an international gold trading centre by year-end. The system would support physical delivery and form part of a wider push to create a commodities trading ecosystem. For global bullion markets, the move could reshape liquidity flows in Asia, offering an alternative hub to Shanghai and Singapore. While still at the planning stage, the announcement underlines the persistent structural demand for gold in central and private markets, reinforcing its long-term appeal even as short-term trading stays range-bound.

Gold outlook

This is still a levels market. As long as $3,300 holds, dip buyers have room to work and the bias tilts mildly higher into event risk. Two strong closes above $3,400 would signal bulls are back in charge and open $3,480-$3,500. A clean break under $3,300 hands control to sellers and puts $3,250 on the tape quickly. For now, patience and tight risk make more sense than chasing.