- Brent crude oil price forecast and analysis for November 2025. Explore why oil prices remain under pressure .

The Brent crude oil price edged higher to around $63.75 a barrel on Friday, stabilizing after a volatile week dominated by oversupply worries and weaker U.S. demand signals. Even with today’s modest recovery, the benchmark is still heading for a second consecutive weekly loss, underscoring how fragile sentiment remains across global energy markets.

Brent Oil Price Today: Modest Lift, but Sentiment Still Soft

By late London trade, Brent futures were up about 0.9%, while WTI crude rose roughly 1%. The move looked more like a relief bounce than a shift in tone. Data from the U.S. Energy Information Administration (EIA) showed crude inventories climbing 5.2 million barrels last week, far above forecasts.

That surprise build quickly revived oversupply worries.

The market keeps wrestling with the same theme, more oil arriving than the world currently needs,”

said one trader at a European commodities desk

OPEC+ and Saudi Pricing Moves Reflect Growing Unease

Earlier in the week, OPEC+ confirmed a small output increase for December but decided to pause additional hikes in the first quarter of 2026. The decision suggests members are wary of flooding the market just as consumption cools.

In Asia, Saudi Arabia cut its official selling prices for December cargoes, signaling that the kingdom is prioritizing market share over pricing power. The move helped steady Brent around current levels even as weak U.S. data continued to weigh on sentiment.

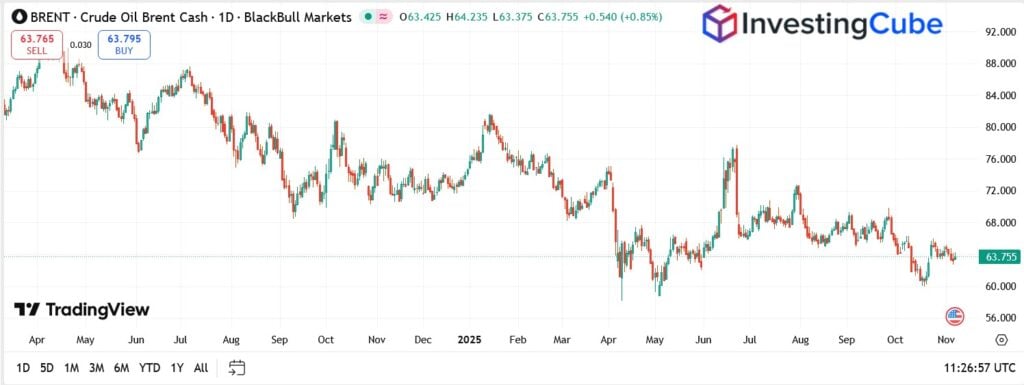

Brent Crude Oil Chart Analysis

Brent continues to drift inside a tight range between $60 and $68. The RSI sits around 48, showing balance between buyers and sellers. The 50-day moving average has flattened, a classic sign of market indecision.

Immediate support is clustered near $62.50, while resistance stands around $66.50 – $68.00. A daily close above that zone could lift prices toward the $70 handle, but failure to defend support might drag the benchmark closer to $60, a level traders describe as “make-or-break” for short-term direction.

China and Global Demand Trends Remain Mixed

China’s customs data offered a rare bright spot. October crude imports rose 2.3% from September and 8.2% year-on-year to about 48 million tons. Analysts say the jump is tied less to consumption and more to stockpiling at state refineries.

China’s still pulling in large volumes, but it’s not translating into stronger fuel demand,”

said UBS analyst Giovanni Staunovo

That dynamic keeps some barrels off OECD markets, yet it hasn’t tightened supply enough to lift prices meaningfully.

At the same time, the U.S. government shutdown and softer jobs data have left traders cautious. A weaker labor market points to slower transport and manufacturing fuel use, which feeds directly into demand projections.

Sanctions, Politics, and Supply Chain Friction

Geopolitics continues to stir volatility. The U.S. Treasury recently blocked Gunvor’s attempt to buy Lukoil’s overseas assets, tightening the screws on Russian oil flows. Ongoing restrictions on Iranian exports add another variable. While these issues support prices at the margin, they haven’t been enough to offset growing supply elsewhere.

Brent Oil Outlook: Can Bulls Hold the Line?

For now, the market looks stuck in wait-and-see mode. Brent is trading close to levels that many view as fair value given inventories and macro sentiment. A decisive move higher would likely need a meaningful production cut or a strong rebound in global fuel demand.

If prices slip below $60, momentum could quickly turn bearish. But as long as Brent stays above that line, analysts expect sideways trade through November, with short bursts of volatility around economic releases and OPEC headlines.

In the short term, oil prices are expected to stay range-bound with a slight downside bias. Analysts see Brent fluctuating between $62 and $68 per barrel as supply remains strong and demand growth slows. However, if OPEC+ signals deeper cuts or global data improves, prices could rebound toward $70 later in the month.

A rebound above $70 would likely need stronger demand or deeper OPEC+ cuts. For now, most analysts expect Brent to trade between $62 and $68 in the near term.

The key drivers include OPEC+ output decisions, U.S. inventory data, global economic trends, and geopolitical tensions involving major oil producers.