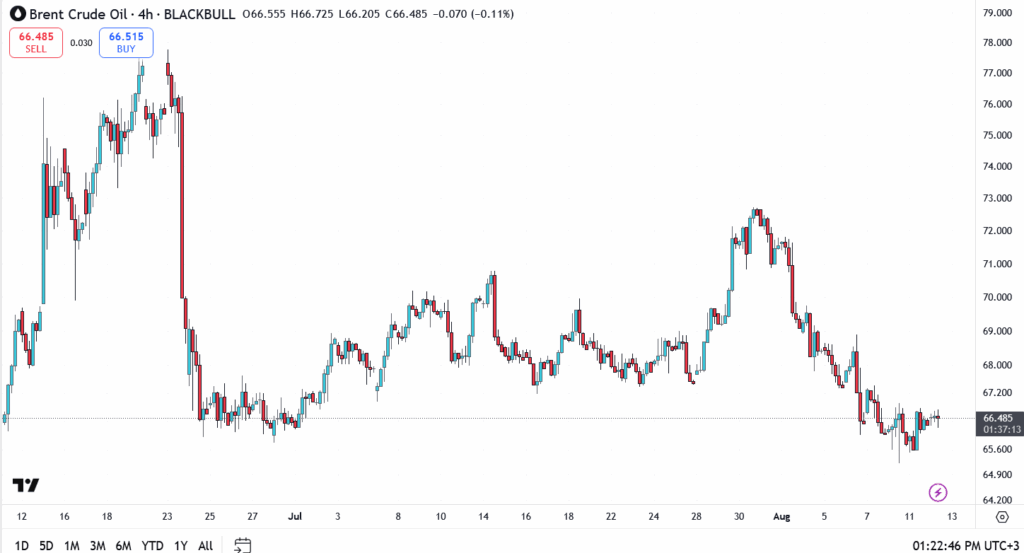

Brent crude oil price hovered near $66.48 a barrel on Tuesday, trading flat after US President Donald Trump extended the tariff truce with China. The decision eased immediate worries about a fresh trade dispute, giving global markets some breathing room. Even so, buyers in the oil market are keeping positions light, with demand signals still looking uneven.

The price action comes after a rough few weeks for Brent. Earlier in August, futures fell sharply from above $72, wiping out weeks of steady gains. That slide was driven by weak economic data, softer summer fuel demand, and the uncertainty hanging over global trade policy. Monday’s calm is less about a bullish reversal and more about traders waiting to see whether macro conditions will improve.

While the tariff reprieve reduces one risk, it doesn’t erase the bigger picture concerns. Refinery runs in China have cooled, US crude inventories are drawing down at a slower pace than forecast, and the stronger US dollar is making oil more expensive for non-dollar buyers.

Demand Outlook Remains Fragile

From an economic standpoint, the truce could help stabilise trade flows in the short term, which is supportive for energy demand. But analysts note that the deal is a pause, not a resolution. Until industrial output and shipping activity show sustained recovery, any bounce in crude could be capped.

Supply Side and OPEC+ Influence

On the supply front, OPEC+ is sticking to its production cuts, but rising barrels from outside the group, particularly in the US and Brazil, continue to balance out those efforts. This has kept the market from building a strong risk premium despite ongoing geopolitical flashpoints.

Brent Technical Analysis

- Current price: $66.48

- Resistance: $67.20, then $68.50

- Support: $65.60, then $64.90

A push through $67.20 could set up a test of $68.50, an area where sellers have been active in recent months. On the flip side, a drop below $65.60 could bring $64.90 into play, a level that acted as support in July.

Outlook: Watching the Data

Brent’s near-term path will depend on fresh demand cues. US inventory data due this week and China’s industrial output figures will be critical in setting the tone. For now, the market has caught its breath, but without stronger consumption signals, rallies are likely to be sold into rather than chased.