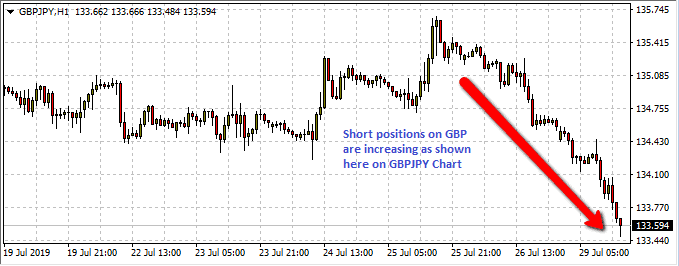

- The Commitment of Traders (COT) report released by the CFTC shows an increase in the number of shorts in the GBP, Euro and other currencies.

The positioning report released by the Commodities and Futures Trading Commission for the week ended July 23, shows a number of important positioning setups that are actively playing out in the FX market.

COT Summary:

In all currency pairs paired against the US Dollar, market participants are net short. The only exceptions are the Canadian Dollar (CAD) and the Mexican Peso (MXN) in all currencies against the dollar except the Mexican peso and the Canadian dollar.

- There has been an increase in the number of speculative net short positions in the British Pound. These GBP shorts have risen to the highest levels in over 10 months as traders grow increasingly uncertain about the ability of the UK government to avoid a no-deal Brexit. This is badly weighing on the sentiment of investors, especially as a key member of the UK government was quoted as saying over the weekend that it was becoming more likely that a hard Brexit could occur.

- Net long positions on the CAD have been rising steadily and are now at a 5-month high. This is reflective of the recent cautious Bank of Canada statement which indicated that solid labour data and robust inflation do not make a case for easing of interest rates.

- There was also an increase in the volume of EUR shorts, which are now at 4-week highs as a result of the recent dovish statement of the ECB in its last monetary policy meeting.

Commitment of Traders (COT) Report Data

- Increase in Short positions seen on GBP, CHF and Euro. Net positioning: SHORT

- Reduction in long positions on MXN. Net positioning: LONG

- Increase in long positions on CAD. Net positioning: LONG

- Reduction in short positions on NZD, AUD and JPY. Net positioning: SHORT

Don’t miss a beat! Follow us on Twitter.