- As the S&P 500 resumes its march above 3400 on the back of Chinese industrial production data, can the index maintain traction above that level?

Stocks continue to edge higher, picking up from yesterday’s bullish close as upbeat Chinese data provided more optimism for a rebound in the global economy. The S&P 500 index has opened 0.87% higher and is currently trading at 3410.

Technology stocks are once more providing leadership on the S&P 500, as risk flows favour the index to push it beyond the 1.5% gain position, which sets it as the best performing of the indices on the S&P 500. The only sector which is down at the moment is the Financials index, which is trailing by 0.11%.

Upbeat data from China show that Industrial Production rose by 5.6% year-on-year, which was an improvement over last month’s 4.8% reading. It also trumped the market expectation of 5.1%. Retail sales also jumped from -1.1% to 0.5%, exceeding the market expectation of 0.0%. Data from Germany also impressed, as the ZEW economic sentiment climbed from 71.5 to 77.4. This reading was a clear push above the 69.7 reading that the markets were expecting.

Technical Outlook for S&P 500

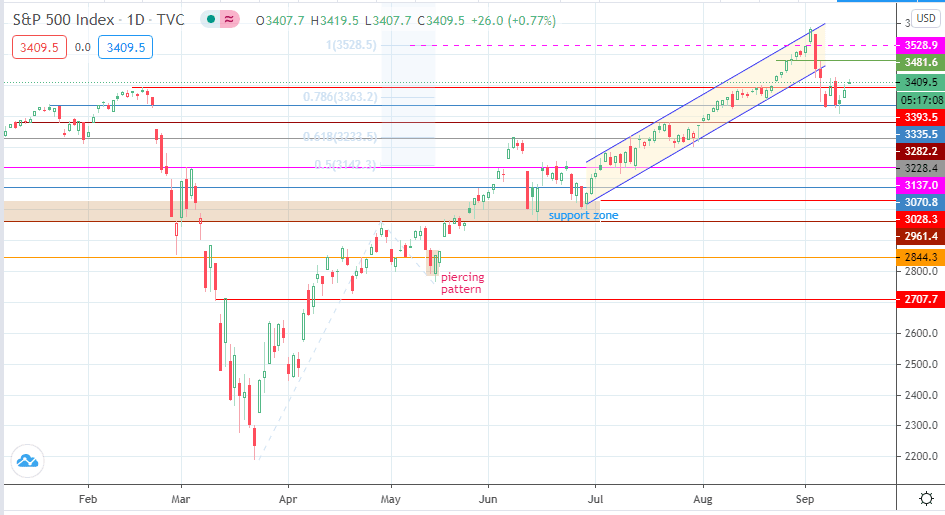

Today’s rise takes the index above the 3393.5 resistance. Today’s candle needs to close above this resistance, followed by another penetration close above the same resistance, to confirm the break of that price level. This will convert this resistance into support, but the S&P 500 will still need some follow-through buying to send it to 3481.6. This pathway may be a straight move, or it could be a move that stems from a pullback and bounce off the 3393.5 price level. Above 3481.6, 3528.9 remains the sole barrier in the quest for a retest of the all-time high of 3588.1.

On the flip side, failure to confirm the break of 3393.5 due to lack of follow-through buying may allow the index to slide towards 3335.5, which is the next downside target below 3393.5. Additional support comes from 3282.2 and 3228.4 in the near term, and each may be a target if sellers re-enter the fray.