The Centrica share price is down 0.21% this Monday, as the price action continues the correction from the 2022 highs attained on 28 July. On that date, UK gas major Centrica PLC announced a massive jump in its first half profits for the 2022 fiscal year, as soaring energy profits and asset sales gave its bottom lines a significant filip.

The Centrica share price surged after the company reported a 5-fold jump in profits from 262 million pounds a year earlier to 1.342 billion pounds. However, the recent corrective decline was set off by the downgrade of the Centrica share price by investment bank Citi. The bank downgraded the stock from “Buy” to “Neutral”.

This downgrade allowed traders who got into the stock earlier to bank profits, sending the Centrica share price lower by 4.65% in August. Citi analysts feel that the solid H1 2022 numbers and optimistic full-year outlook may face headwinds from geopolitical pressures in the coming months. The Centrica share price saw its best month of 2022 in July, gaining 9.62% on the back of the profit surge.

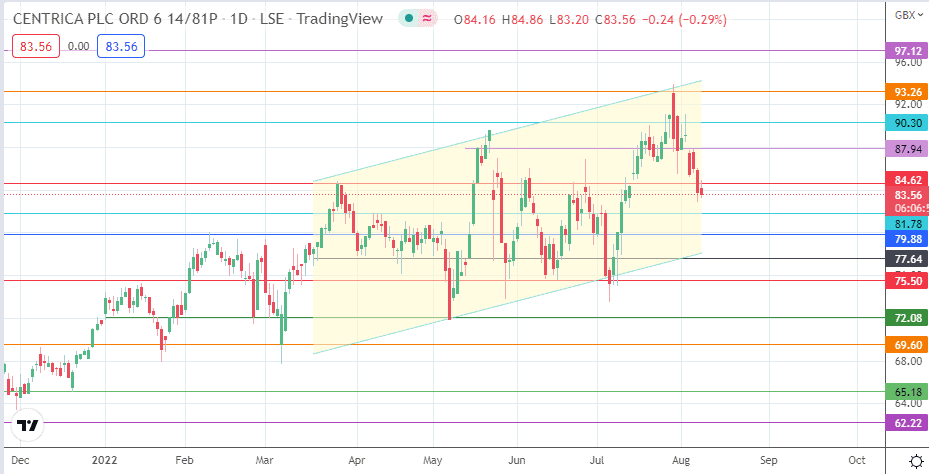

Centrica Share Price Forecast

With the correction move having breached the 84.62 price mark, the return move has met resistance at the same level, which now acts as a resistance in role reversal. As a result, the bears must push the price further south to target the 81.78 support level (7-9 April highs, 9 June low).

Other underlying support levels are seen at 79.88 (23 March low and 1 July high) and 77.64 (15 May and 16 June 2022 lows). Only when this last support is broken can the channel be degraded, opening the door for the approach to 75.50 (6 May and 7 July lows) and the 9 May low at 72.08.

Conversely, the 18 May and 22 July highs at 87.94 await the bulls on a break of 84.62. If the bulls clear this resistance, the 90.30 and 93.26 price marks lie in wait, the latter being the site of 2022 highs. A clearance of 93.26 breaks the channel’s upper border and restores the uptrend, leaving 97.12 (13 May 2019/7 June 2019 highs) as the next target in line.

Centrica: Daily Chart