- The Aave price remains capped by the long term moving averages. But for how long can they hold out in the current environment?

The Aave price remains capped by the long term moving averages. But for how long can they hold out in the current environment? Aave (AAVE) has hardly moved for the last month, despite the cryptocurrency market surging to a record valuation of $3 trillion. At the current price, Aave has gained just 7% so far in November, far underperforming the competition.

Of course, it’s not all bad news for Aave holders. The price has appreciated around 275% since the start of the year and doubled from the June low. However, unlike many cryptocurrencies, AAVE is half the value it was in May. The recent underperformance follows a $5 billion drop in the Total Value Locked (TVL) at the start of the month.

However, capital is starting to return to the protocol. Aave’s TVL has increased by around $3 billion over the past week, but the token has failed to respond. Furthermore, considerable overhead resistance provides a severe obstacle for the bulls to overcome.

Price Analysis

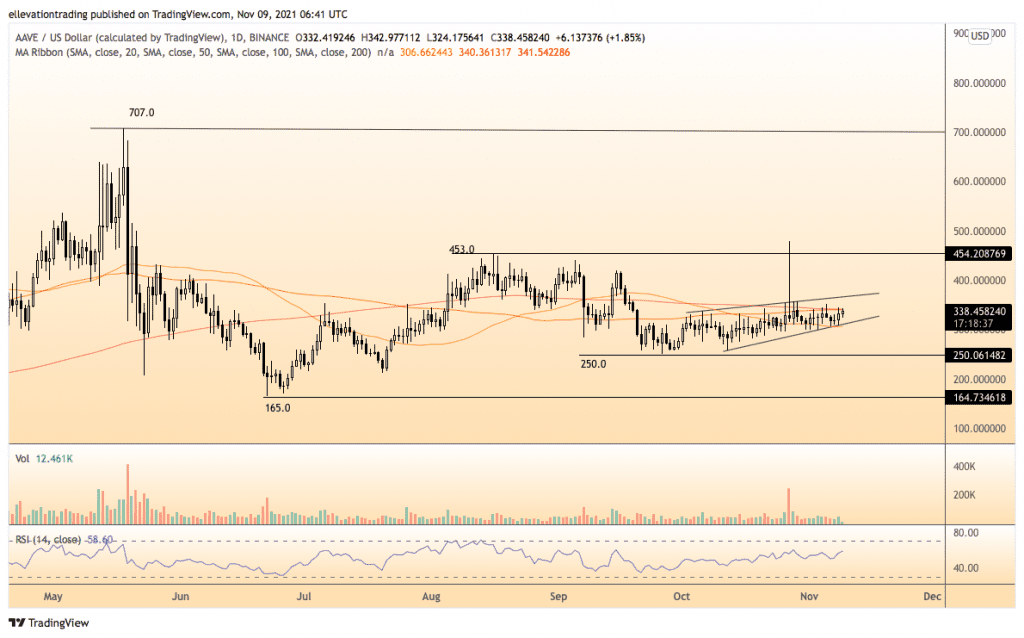

The daily chart shows the token is struggling to hurdle the 100 and 200-Day Moving Averages at $340.35 and $341.53, respectively. However, successful clearance of $430.35 (on a closing basis) should encourage bullish momentum, initially targeting trend resistance at $366.50. At the same time, a more pronounced rally could bring the August high of $453 into view.

However, the Aave price remains vulnerable until it closes above $366.50. Should the token turn lower, the first support is a rising trendline aligned with the 50-DMA at $306.62. Below the trend, an extension towards the September of $250 is possible.

On balance, I favour the bullish scenario considering the cryptocurrency market’s buoyancy. However, traders should wait for a confirmed close above the 200-DMA before deciding whether to allocate capital to the token.

AAVE price Chart (daily)

For more market insights, follow Elliott on Twitter.