- The CAD/JPY may have gained ground on less dismal than expected jobs data, but falling crude oil prices remain a downside risk.

The CAD/JPY is up 0.69% on the day as traders upped their demand for the Loonie following upbeat employment data out of Canada. Data from Statistics Canada showed that the unemployment rate remained stagnant at 4.9%, better than the market expectations of a rise to 5.0%. The economy also lost 30.6K jobs, but despite not meeting the prediction of economists who foresaw the addition of 14.2K jobs, the degree of job loss was less than the previous month’s drop of 43,200 jobs.

The data was seen more from the perspective of the glass being half full and not half empty, which retains the uptick of the CAD/JPY pair. However, the Loonie is likely to see these gains capped as crude oil prices have lost their earlier gains on the day and look set to post the fifth day of losses in six. WTI crude is trading 0.72% lower at $87.51, while the international crude oil benchmark (Brent) is down 0.48% and currently trades at $93.08.

CAD/JPY Forecast

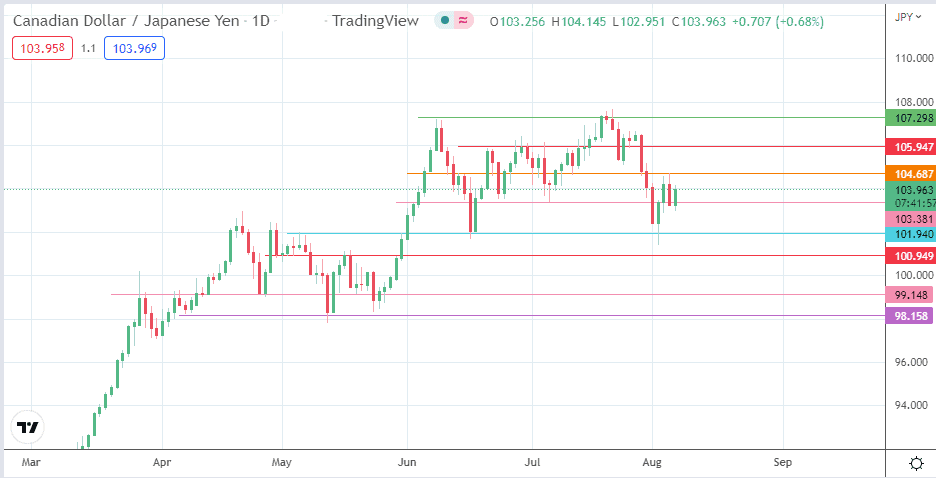

The 104.687 is the resistance to beat if the CAD/JPY pair is to secure a resumption of the uptrend move that followed the bounce on the 101.94 support (17 June low). If the bulls uncap this resistance, the path toward the 105.947 resistance target (30 June high and 26 July low) becomes clear. Above this level, the 107.298 price mark becomes the new harvest point for traders on the long side of the equation.

On the flip side, rejection at the 4 August high at 104.687 could initiate a new round of correction. This correction only gathers steam if the bears break down the 103.381 support level (6 July low). Additional downside targets along the path of the corrective move include 101.940 and 100.949 (4 May low). 99.148 (26 April and 19 May lows) and 98.209 (7 April low) are additional harvest points for the bears if the bulls fail to defend the 100.00 psychological support.

CAD/JPY Daily Chart