- The jump in UK consumer inflation could drive up bullish bets on the GBP/USD, as expectations of hawkish BoE actions heighten.

The GBP/USD has edged modestly higher this Wednesday after a jump in UK inflation created demand on expectations of monetary policy tightening by the Bank of England.

Data showed that consumer prices rose 3.2% on an annualized basis in August, beating estimates or a rise to 2.9% from the July figure of 2.0%. This jump in consumer inflation from 2.0% to 3.2% represents the most significant jump in the annualized figure in 24 years, and the number also marked the highest UK inflation has been in 9 years.

The stronger-than-expected inflation data has heightened expectations that the BoE could embark on a tighter monetary policy cycle earlier than the Federal Reserve, and this is driving bullish bets on the GBP/USD on the day. The projections by the BoE are for inflation to hit 4% at the end of 2021.

The pair is up 0.12% on the day after giving up some earlier gains.

GBP/USD Outlook

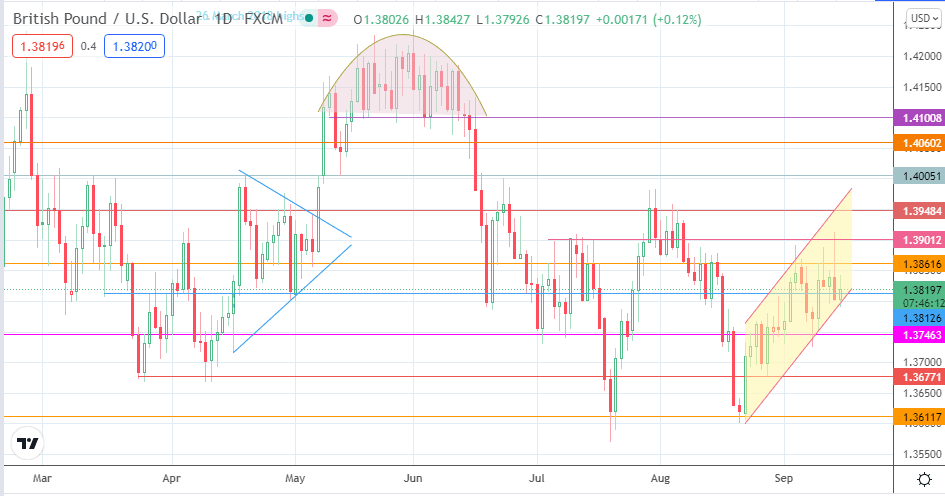

The intraday bullishness on the GBP/USD stems from a bounce on the trendline of the channel on the daily chart. This action has preserved the integrity of the 1.38126 support level for now. If there is more follow-up buying, we could see a push towards the 1.38616 resistance before 1.39000 comes into the picture. Additional upside targets are seen at 1.39484 and 1.40005.

On the other hand, a decline below the 1.38616 support and the channel’s trendline could spur a decline towards 1.37463. 1.36771 and 1.36117 are also potential targets that only become viable if there is a deeper correction.

GBP/USD Daily Chart

Follow Eno on Twitter.