- The dollar is making good progress, and the EURUSD trades lower as Fed’s Bullard said that the current economic situation does not warrant a 50-bps rate cut

The dollar is making good progress vs. most of its peers as Fed’s Bullard said that the current economic situation does not warrant a 50-bps rate cut. Yesterday, the fed funds rate market were projecting a 50-bps rate cut by 42.6%, but now that has dropped to 30.2%, and the market is giving it a 69.8% probability of just a 25-bps rate cut at the FOMC July meeting.

It also looks like Bullard is interested in cutting rates just for the Fed not be too behind the curve. However, statistics by Nordea markets published last week showed that the Fed tends to cut much more than the markets tend to project. So, while the markets appear wrong footed right now, I suspect even the Fed might be getting it wrong, as US economic data should probably continue to deteriorate in the weeks ahead.

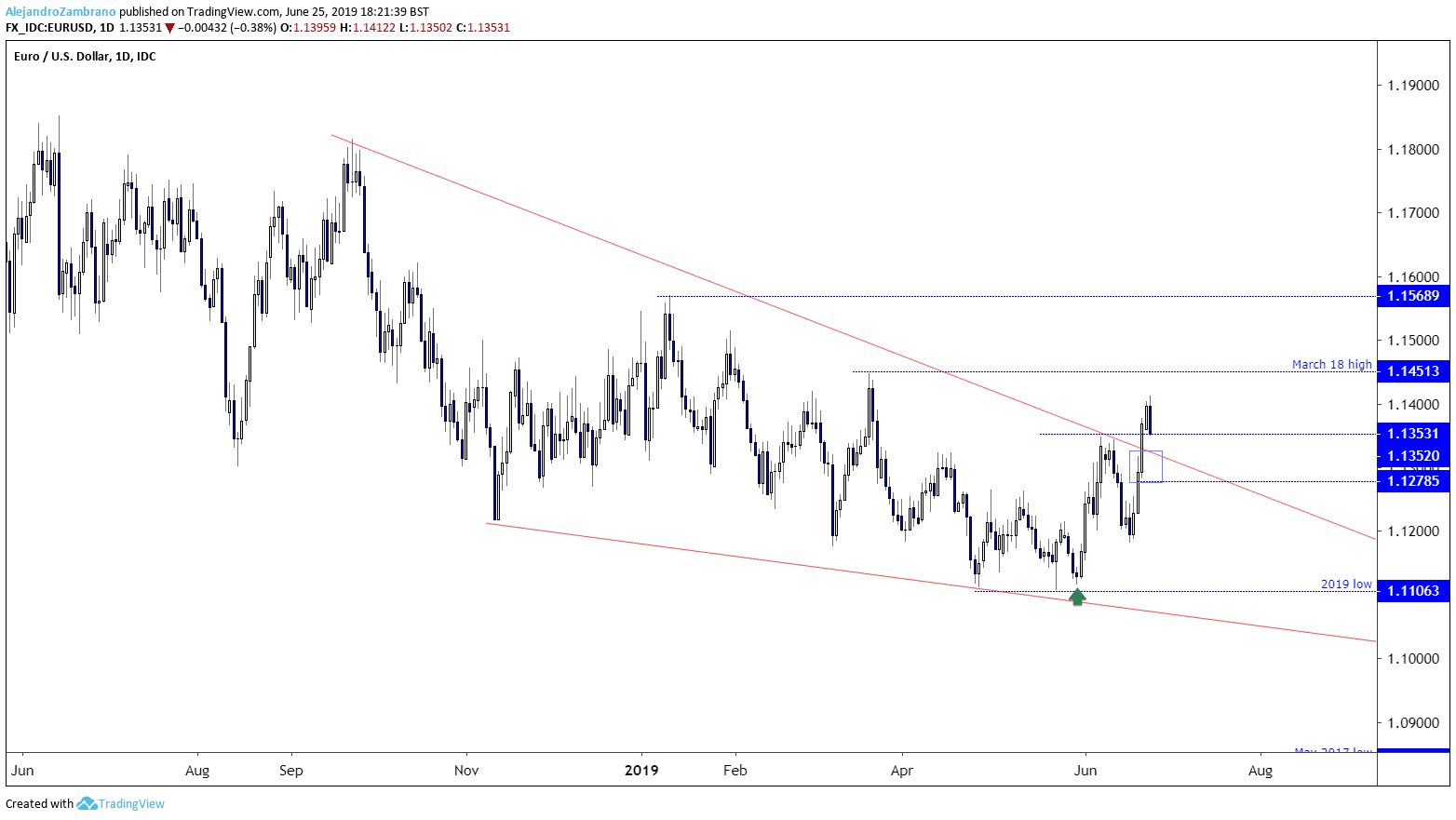

EURUSD has traded lower on the comments and is trying to move back into the wedge pattern completed last week, and I suspect we might see slightly lower price in the next day or so but as long as the price trades above 1.1278 the short-term trend should remain bullish.

Gold prices have also turned lower and might reach the $1405 level, as mentioned earlier today.