- The Brent crude oil price is trading at an important resistance level as investors focus on the happenings in China. What next

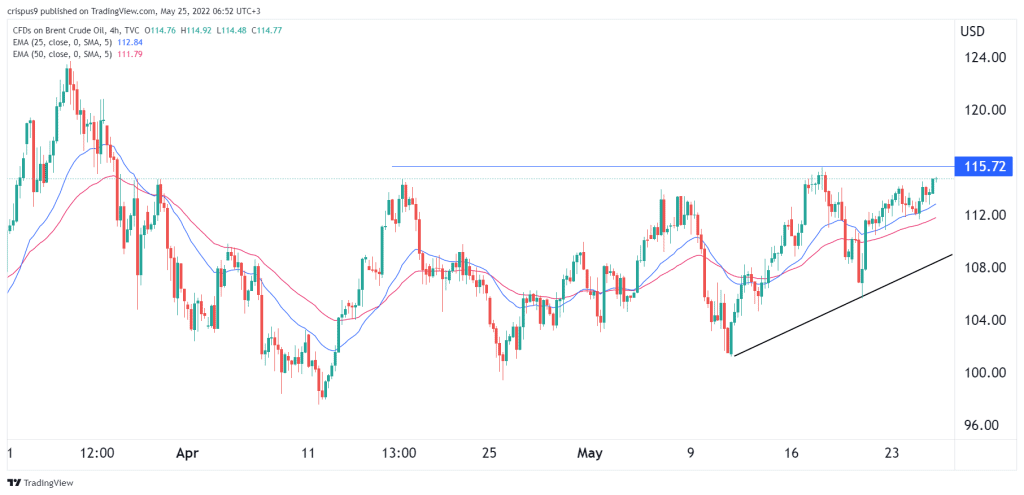

The Brent crude oil price is trading at an important resistance level as investors focus on the happenings in China. It is trading at $114.86, which is close to the important resistance level at $115.72. It has risen by more than 17.8% from the lowest level in April. Similarly, the West Texas Intermediate (WTI) is trading at $111, which is20.2% above the lowest point last month.

The most notable debate in the financial market these days is about an upcoming recession. Some analysts believe that the probability of a recession has increased substantially in the past few weeks. This thinking has been fueled by the forward guidance by top retailers like Walmart, Target, Kohls, and Abercrombie & Fitch. These firms warned that they were experiencing significant margin pressures as the cost of doing business rose.

Recession worries have also been fueled by the hawkish tone by the Fed. The bank has signaled that it will continue hiking interest rates and start winding down its balance sheet in the coming months. Also, the ongoing lockdowns in China have contributed. Historically, Brent crude oil price tends to underperform in a period of recession.

Another catalyst for oil prices is the fact that the EU is nearing a decision to ban Russian crude. This will be a notable thing since Russia will need to reroute its crude to other countries.

Brent crude oil price prediction

On the four-hour chart, we see that the Brent crude oil price has been in an upward trend in the past few weeks. The price is now nearing the important resistance level at $115.72 where it has struggled to move above several times since April. The price is also above the ascending trendline shown in black and the 25-day and 50-day moving averages.

Therefore, we can conclude that Brent is on the cusp of a bullish breakout ahead of the US inventory data. If this happens, the next key resistance level will be at $120. A drop below the key support at $112 will invalidate the bullish view.