On Tuesday, the Walmart stock price collapsed after the company reported disappointing earnings that missed financial targets. The disappointing earnings paradoxically came when the retail sales data beat the market expectations.

The Walmart stock price closed 11.38% lower after a 25% drop in quarterly earnings, forcing the company to downgrade its full-year outlook. Walmart is blaming inflation, rising fuel costs and higher wages. Just as occurring in the UK and other parts of the world, 40-year highs in consumer inflation are forcing shoppers to reduce spending on non-essential items while substituting branded products with cheaper alternatives.

Walmart’s Q1 2022 earnings came in at $1.30 per share, lower than the $1.69 earned in the same period the previous year and lower than analysts’ estimates of $1.48 per share. The company has cut its full-year earnings estimates from the prior value of a mid-single-digit growth to a 1% decline. Sales rose slightly from $138.5 billion in the same quarter of last year to $141.6 billion. This jump beat the market estimate of $138 billion.

The 11.38% decline is the most significant daily drop in the Walmart stock price since 16 October 1987. This was the Friday that preceded the 19 October 1987 Black Monday crash that wiped off a fifth of the Dow’s value. The stock now trades at lows, last seen in March 2021.

Walmart Stock Price Prediction

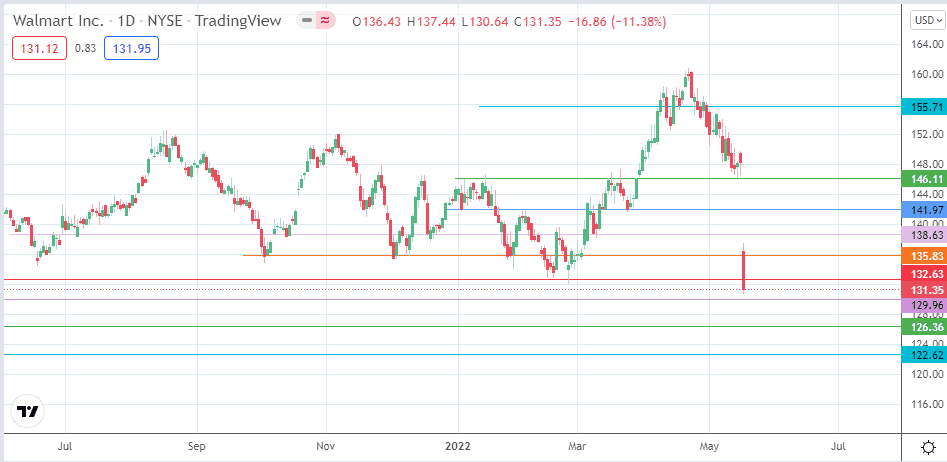

The considerable drop has violated the support at 132.63 (16 March 2021 and 24 February 2022 lows). A further dip in price makes the 129.96 support vulnerable. If the bulls fail to defend this support, the 126.36 pivot (4 March 2021 low) comes into the mix. The 122.62 pivot is additional support created by the previous highs of 10/25 June 2021, acting in role reversal.

On the flip side, the bulls must force a penetration close above the 132.63 price mark to preserve this level as a support. Additional momentum carries the price activity towards 135.83 (9 December 2021 and 26 January 2022 lows). 138.63 (9 March low) becomes available on clearance of 135.83, leaving 141.97 (23 March low) and 146.11 (13 May 2022 low) as additional targets to the north if the advance continues.

Walmart: Daily Chart