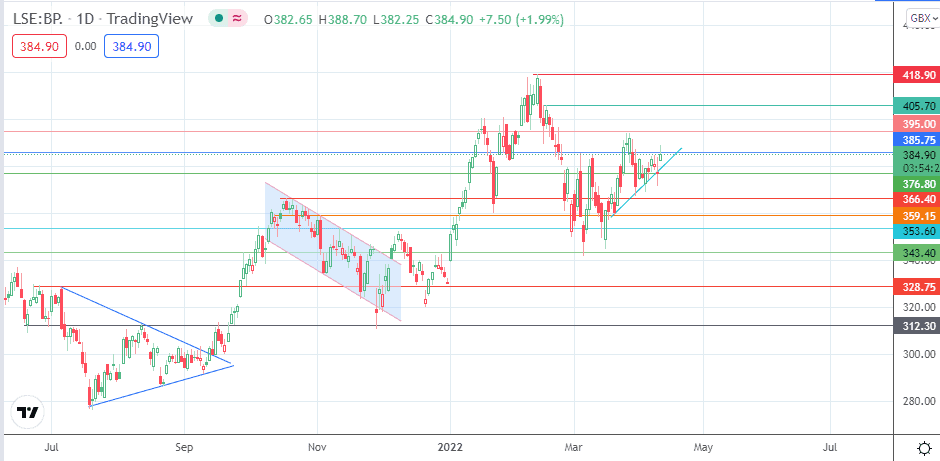

- The BP share price direction will be decided by the outcome of the symmetrical triangle pattern on the daily chart.

The BP share price is presently occupying the 13th spot on the FTSE 100’s gainers’ board this Friday, after notching gains of 2.03% as of writing. The stock had traded as high as 388.70p on the day before rejection by the bears at the 385.75 resistance shaved some of these gains.

The recent upside shown in the BP share price action comes from increased demand for the stock as energy prices rise. However, the spikes seen in the early part of the year appear to have slowed as the company begins deliberations with state-owned energy companies in a bid to divest from its Russian holdings. A report from an industry website, quoting Bloomberg News, says that the British oil giant has approached Sinopec Group and China National Petroleum to sell off its 20% stake in Russian state-owned Rosneft PJSC.

The report also says BP has made approaches to interested parties from the Middle East and India. Industry experts expect the transaction to be done at a discounted price, which the company says could cost it up to $25bn.

BP Share Price Outlook

Further advance on the Shell share price requires a break of the current resistance at 385.75. The active candle is testing this barrier but has found no success yet. If the bulls eventually uncap this resistance, 395.00 (25 March 2022 high) becomes available as a new target. This move confirms the break of the triangle to the upside.

The 16 February 2022 high at 405.70 could form a further barrier up north before the 2022 high at 419.15, seen on 11 February 2022, becomes a new milestone for the bulls. On the flip side, rejection at the 385.75 resistance could lead to a pullback move that immediately challenges the triangle’s lower border.

A breakdown of this border invalidates the upside expectation and immediately presents a challenge to the 376.80 support line. A breakdown of this support allows 366.40 to become a new target to the south before 359.15 and 353.60 become potential new harvest points for short-sellers trading off the trendline’s breakdown.

BP: Daily Chart

Follow Eno on Twitter.