The Boohoo share price is down 3.41% as the stock finds the march to previous pandemic-level highs too much of an uphill task. This is the third straight day of losses and a fourth in five sessions as short sellers in hedge funds continue to offer the stock following an investigation into the company by the Competition and Markets Authority.

So what is the story here? The UK’s market competition regulator announced the so-called “greenwashing” investigation on 29 July. This investigation seeks to check if Boohoo’s advertising claims on the eco-friendliness of its processes and products are misleading or not. Boohoo is one of two companies being investigated, the other being Asos, another fashion retailer.

The Boohoo share price has lost one-sixth of its value since this announcement. Not even the news of the company’s acquisition of 7% shareholding in Revolution Beauty Group has been able to stir up demand for the stock this Wednesday.

From the standpoint of technical analysis, a bearish chart pattern is emerging, and this could be the defining factor for the next few days as far as the direction of the Boohoo share price is concerned.

Boohoo Share Price Forecast

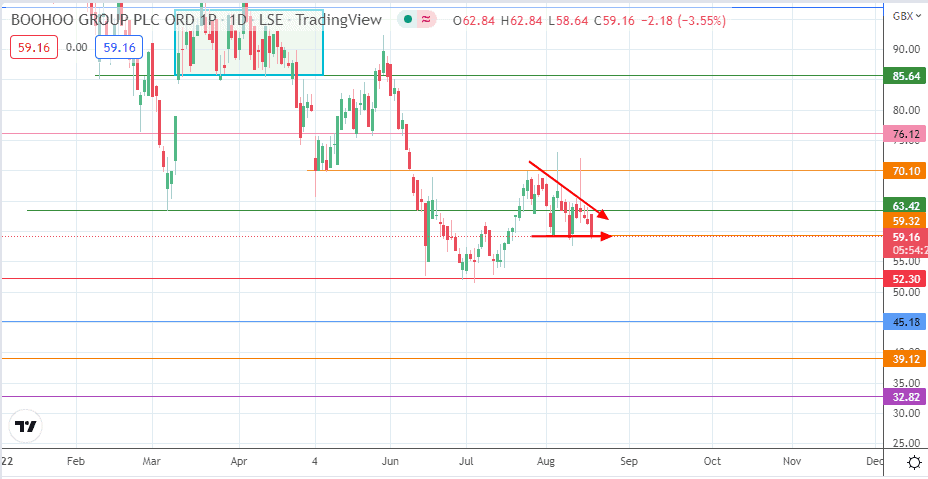

The active daily candle is testing the 59.32 support, which is formed by prior lows of 3 August and 9 August. Combined with the progressively declining tops, the evolving chart pattern is that of a descending triangle. A breakdown of the 59.32 support completes the triangle and opens the door to a measured move that ends at 52.30 (30 June/5 July lows).

If the price deteriorates further, the bears will have access to the 45.18 support (5 May 2016 low). Additional harvest points at 39.12 (12 February 2016 low) and 32.83 become viable if the decline continues, in furtherance of the bearish structure.

On the flip side, a bounce on 59.32, which takes out the 63.42 barrier formed by the 14 June, 22 July, and 5 August lows, invalidates the pattern and gives the bulls clear skies to aim for 70.10 (25 July high). A break of this level gives the bulls access to 76.12, where the previous lows of 25 May and 8 June are located. 85.64 is another upside target that lies beyond 76.12, but this target remains non-viable for now.

Boohoo: Daily Chart