- The Boohoo share price could get a lift from the Citadel Group's 5% equity purchase, as it seeks to bounce from 2016 lows.

The Boohoo share price closed 3.71% higher on Wednesday after Ken Griffin’s US-based Citadel Group had taken up a 5% stake in the online fashion group. Citadel, one of the world’s biggest hedge funds, is now the fifth-largest shareholder in the company. The news provides some tailwinds for the Boohoo share price, which could see more demand for its stock when the London Stock Exchange opens its door for trading within the hour.

The entry of Citadel provides a break for the Boohoo share price, which has been battered for several months by dwindling demand for its products and a high product return rate. The stock is now testing lows last seen in 2016 after it shed 82% off its pandemic highs in 2021.

Boohoo was one of the stocks classified as “lockdown winners” after its indoor wear became popular among locked-down UK residents following the enforced restrictions in 2020 and 2021. A removal of movement restrictions saw a return to old shopping habits, denting the company’s fortunes.

The Boohoo share price had fallen as low as 52.30p after investment bank Exane BMP cut its rating to neutral (outperform), with a 60p price target. This price target is a tad higher than the current market price, with 110p being seen as the upper end of the price target.

Boohoo Share Price Forecast

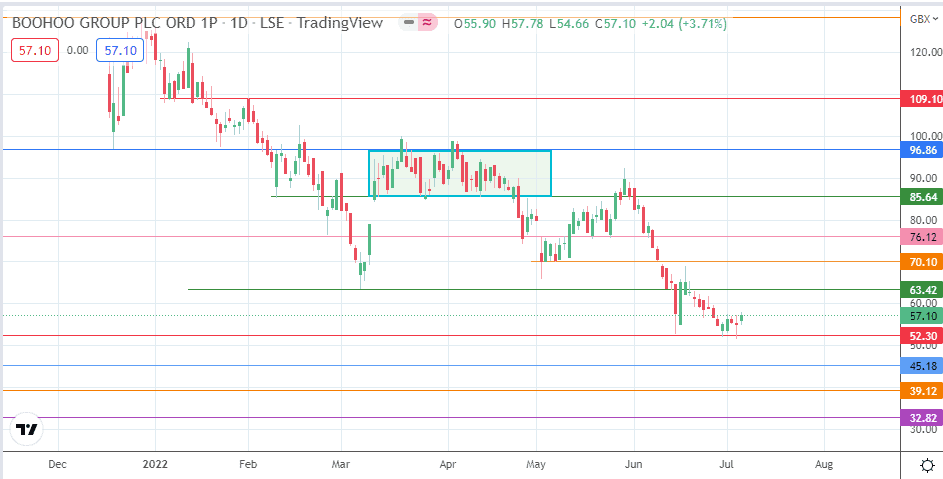

Following the doji candle’s formation on the 52.30 support level (30 June low), the price ticked upwards and could continue in that direction as the bulls aim to force the price action toward the 63.42 resistance mark (22 June 2022 high).

A clearance of this resistance sends the price action toward the 70.10 resistance, where a previous low was seen on the 5-10 May candles. Additional barriers to the north come in at 76.12 (11 May high and 25 May/11 June lows) and 85.64, where the completed rectangle’s floor is found.

However, a breakdown of the 52.30 support level continues the downtrend in the stock. This downside break has the 45.18 pivot as its initial target, being the site of the prior low of 29 April 2016. Additional targets to the south lie at 39.12 (11 February 2016 low) and at the 22 December 2015 low of 32.82.

Boohoo: Daily Chart