- In the last 24 hours, investment bank currency analysts have scrambled to markdown EUR/USD price targets as the dollar index sets a new record for 2021.

In the last 24 hours, investment bank currency analysts have scrambled to markdown EUR/USD price targets as the dollar index sets a new record for 2021. This morning, a resurgent greenback continues to gain ground against the Euro, pushing the trading pair below $1.1700 for the first time in 2021.

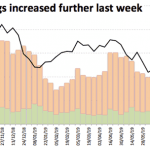

Just as the Euro plunges has plunged to a 9 month low, DXY is achieving the opposite. This morning the Dollar Index is trading at 93.51, its highest level since November 2020. This follows a recent uptick in taper talk and a safe-haven bid for the buck. As a result, Commerzbank forecast the Euro could trade below $1.1575, leading to a possible extension to $1.1453. This negative view is echoed by Danske Bank, who told clients they favour a stronger dollar, with a 6-month EUR/USD price target of $1.1500.

EURO vs Dollar technical Analysis

The daily chart shows the Euro has been losing ground against the for the last two months. This has seen the EUR/USD price decline almost 5% from the June $1.2254 high. Furthermore, the price action has formed a descending wedge pattern that may soon break. The lower edge of the falling wedge is seen at today’s $1.1666 low and has so far held out. However, the real test will come this afternoon when the US traders turn on the screens. Should the Dollar Index continue higher this morning and confirm the breakout, the EUR/USD will succumb to selling pressure.

A break below $1.1666 should see the price extend lower, where an obvious target is November’s $1.1602 low point. However, if DXY pulls back from resistance, the Euro may reverse its losses. Although, unless the pair climbs above the top edge of the wedge pattern at $1.1816, the risk is skewed to the downside.

EUR/USD Price Chart

For more market insights, follow Elliott on Twitter.