The Aviva share price started the second trading day in June on a positive note. The stock is up 0.89% as trading on the London Stock Exchange resumes after the 4-day platinum jubilee celebration of Queen Elizabeth’s reign on the British throne.

Paradoxically, the fact that a woman has been on the throne for seven decades has still not rubbed off on some company shareholders, accused of making sexist remarks at Aviva CEO Amanda Blanc. Nevertheless, the storm created has played a part in the underwhelming performance of the stock since then.

The stock has gained 50p since the Aviva share price slumped on 16 May. This drop was due to the consolidation of shares under a new B share scheme, part of the company’s announced capital return to shareholders.

Despite being down nearly 25% since 2017, with most of these losses being the company’s hit due to COVID-19, the signs for recovery look bright. The company has stood by its previous dividend guidance for 2022 and 2023, where it expects to pay its shareholders 31p and 32.4p, respectively. The capital and share consolidation returns should also give investors 7.6% and 7.9%, respectively.

The Aviva share price target provided by institutional investors stands at 525.71p. This gives the stock a potential upside of 21.52% and could see the stock attain its immediate pre-consolidation high.

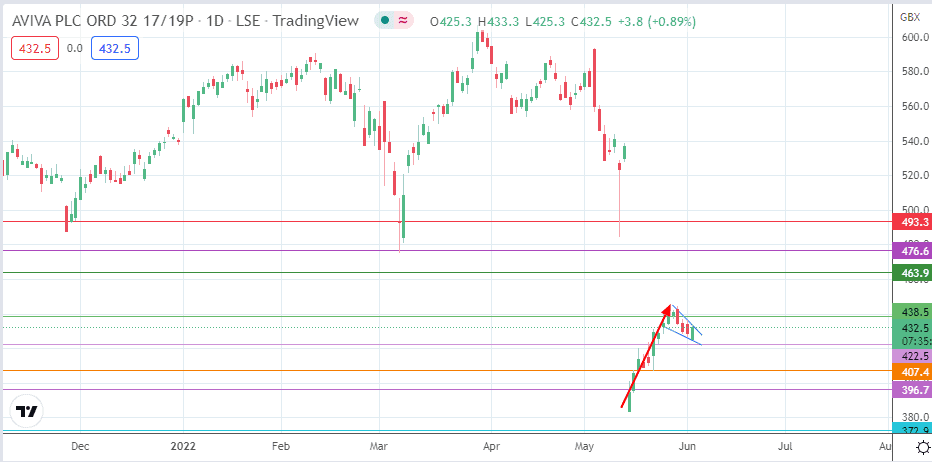

Aviva Share Price Forecast

The evolving bullish pennant is the dominant technical pattern. The uptick of the day preserves the 422.5 support level and keeps the pattern valid. It also leaves the door open for 438.5 to become the next target in line. A break of this resistance leaves the bulls with clear skies to aim for the 463.9 barrier, which is where the previous highs of 8/25 January 2021 are seen.

Above this level, an advance targets 476.6 (15 February 2021 low and 8 March 2022 high), allowing the price action to cover the 16 May 2022 downside gap. 493.3 is another target to the north, becoming viable if 476.6 is cleared.

On the flip side, a retest of 422.5 could be on the cards if the bears resist attempts at an advance at 438.5. If the support at 422.5 gives way, 407.4 (21 December 2020 and 23 May 2022 lows) enter the mix as additional targets to the south.

Aviva: Daily Chart