- AUDUSD trades higher for the third consecutive session as the rebound from 2003 lows is still intact boosted form the QE announced yesterday by Fed.

AUDUSD trades higher for the third consecutive session as the rebound from 2003 lows is still intact boosted form the QE announced yesterday by Fed. The Australian dollar was under selling pressure since the coronavirus outbreak as investors dump Aussie dollar due to the extensive trade relationship with China.

Investors shift their attention to safe-haven assets such as the dollar and run away from commodities pegged currencies. The Reserve Bank of Australia and the Fed announced the establishment of US$60 billion swap line to provide USD in exchange for AUD. The US dollars will be available to local institutions by the RBA in US dollar repos against Australian dollar-denominated securities.

On the economic data front, the Aussie Manufacturing PMI came in at 50.1, beating the expectations of 50 in March. The Composite PMI dropped from 49 to 40.7, while the Services PMI came in at 39.8 below the forecasts of 48.3.

Read our Best Trading Ideas for 2020.

AUDUSD Levels to Watch

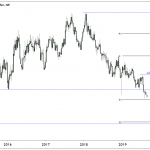

AUDUSD is 2.09% higher at 0.5945 as the rebound from 2003 lows gaining momentum above 0.59. The technical analysis outlook despite the recent rebound is still bearish. Today’s move might help the pair to exit the oversold area that is hovering inside for the last eight sessions.

On the upside, first resistance for the pair stands at 0.5975 the daily high. Above that, more offers will be met at 0.6020 the high from March 18. The next supply zone for the pair would be reached at 0.6148 the high from March 17th.

On the flip side, immediate support for the pair will be met at 0.5813 the daily low, while a break below might test the 0.57002 the low from March 23. In case of a move lower, the next support area stands at 0.5508 the low from March 19.