- AUDUSD trades 0.05 percent lower at 0.7034 after Aussie economy wide spending stalled in June according to CBA Business Sales Index.

AUDUSD trades 0.05 percent lower at 0.7034 after Aussie economy wide spending stalled in June according to CBA Business Sales Index. That was the weakest monthly growth rate in over two years. Consumer caution and the onset of cold and wet weather appeared to discourage Australians. Reserve Bank of Australia cut rates in June and July the first back-to-back cuts in 7 years.

Last week AUD felt the heat as number of Aussie fund management companies have exposure to financing projects related to Chinese wealth manager Noah Holdings, which said that 3.4 billion Yuan of financial products linked to entertainment-to-health care conglomerate Camsing Global’s accounts receivables from JD.com were in danger of default.

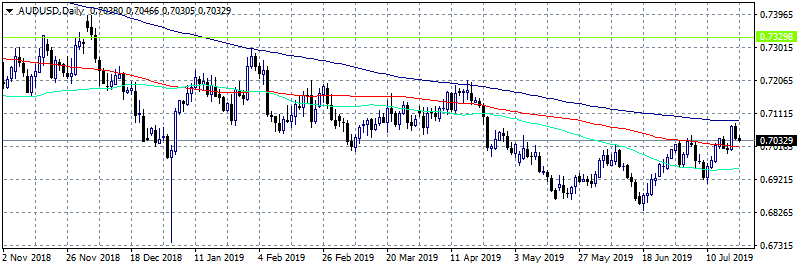

AUDUSD currently consolidates after a failed break above 0.7080. Fundamental data do not support a move higher above the immediate resistance at 0.7090 the 200 day moving average. On the downside first support now stands at 0.7016 the 100 day moving average, a level that if breached will signal the closing of long positions that started to follow the recent uptrend and some traders may enter short positions targeting the 0.6953 mark where the 50 day moving average stands. A wait and see stance on the pair looks like the best strategy for now.Don’t miss a beat! Follow us on Twitter.