- The Aussie was flat against the Kiwi after the release of the Reserve Bank minutes in Australia. The bank held rates steady at 0.25% as expected.

The Aussie was flat against the Kiwi after the release of the Reserve Bank minutes in Australia. The bank held rates steady at 0.25% as expected and the minutes showed that the bank was committed to maintaining their “highly accommodative settings” as long as was needed.

The minutes brought no surprise because the RBA Governor Philip Lowe has said recently that the 0.25% level is a floor in rates that the bank would like to stay in place. The NZD strength is maybe a little surprising because there is talk of negative rates coming in the Kiwi economy.

The real test for the AUDNZD pair will be the Thursday release of New Zealand GDP and Australian unemployment. The Aussie jobs report was a key factor in the monetary policy decisions of Governor Lowe in early-2020 before the Coronavirus damage to the economy. The figures this week are indicating a loss of 50k jobs and an uptick in the unemployment rate to 7.7% so this will be a closely-watched number to see if the Aussie economy can outperform expectations.

The same day will actually see second quarter GDP from the New Zealand economy so Thursday will be a volatile, and pivotal, day for the AUDNZD. Analysts are expecting a -13.3% print for Kiwi growth in Q2.

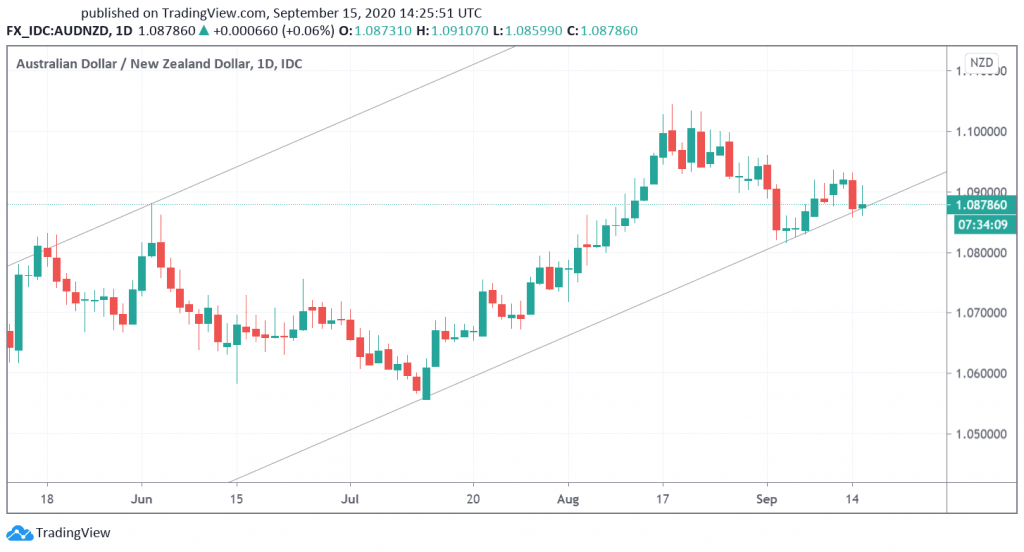

AUDNZD Technical Outlook

The AUDNZD pair is still holding the price channel support but a weaker close today could signal a break lower in the days ahead. Support is at 1.0800 and a break below would open lower levels. Resistance at 1.0950 would see the higher levels at 1.1000 tested.