- The RBA's extension of the bond-buying program by three months and the rise in US long-term bond yields has caused a 94-pip drop in the pair.

The Reserve Bank of Australia’s decision to extend its bond-buying program, coupled with rallying US long-term bond yields for a second day, is driving heavy selling on the AUD/USD. The pair has lost 0.74% as selling continued well into the New York session.

Despite the RBA tapering its bond-buying program, the bank decided to continue the purchases until February 2022, marking a three-month extension in a move that created heavy disappointment among market participants.

A further rally in long-term US Treasuries was enough to ensure the greenback shook off the disappointment of Friday’s jobs numbers, as traders offloaded the Aussie Dollar.

A collapse in gold prices, to which the Australian Dollar is correlated, ensured that the pair completed a 94-pip drop on the day.

Technical levels to Watch

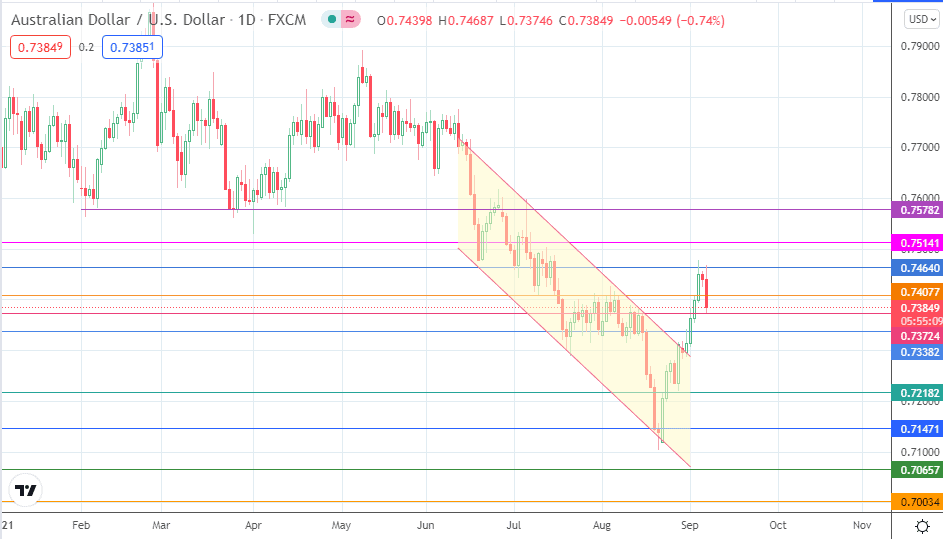

Tuesday’s retreat stemmed from price rejection at 0.74640. This move broke down the 0.74077 support and has found a temporary pivot at 0.73724. If this pivot gives way, bears would have free reign to target 0.73382, with 0.72182 remaining an ambitious downside target.

On the other hand, a recovery bounce on 0.73724 could enable the bulls to aim for a recovery of 0.74077. If this is successful, 0.74640 becomes the next target that needs to give way to restore the bullish move that started on 23 August. New targets at 0.75141 and 0.75782 may then be sought on a successful break of 0.74640.

AUD/USD Daily Chart

Follow Eno on Twitter.