- The AUD/USD pair crashed to a low of 0.6731, which was the lowest level since June 2020. What next for AUD to USD?

The Australian dollar crash continued on Tuesday morning after the latest consumer and business confidence data. The AUD/USD pair crashed to a low of 0.6731, which was the lowest level since June 2020. It has fallen by more than 7.58% from its highest point in June as the dollar strength continued.

AUD to USD exchange rate crash

The Aussie continued falling against the US dollar on Tuesday. Data published by Westpac showed that consumer confidence dropped to -3.0 in June as inflation surged. Further data by NAB revealed that business confidence declined from 6 in May to 1 in June. Most of the respondents cited the soaring inflation as the main reason why confidence declined.

Business and consumer confidence are important metrics because they have an impact on spending. Highly confident businesses spend more money in capital investments and hiring. Similarly, confident consumers spend more money on basic things. Consumer spending is a major part of the Australian economy.

The AUD/USD pair also declined because of the strong US dollar. The greenback strengthened against most currencies, including the euro, pound, and Swiss franc. The sell-off gained steam after last week’s strong jobs numbers. The data showed that the American economy added over 372k jobs in June while the unemployment rate remained at 3.6%.

The next key mover for the AUD to USD exchange rate will be the upcoming American inflation data scheduled for Wednesday. Economists expect the data to show that inflation rose to 8.8% in June as the cost of gasoline crossed $5 per gallon.

AUD/USD forecast

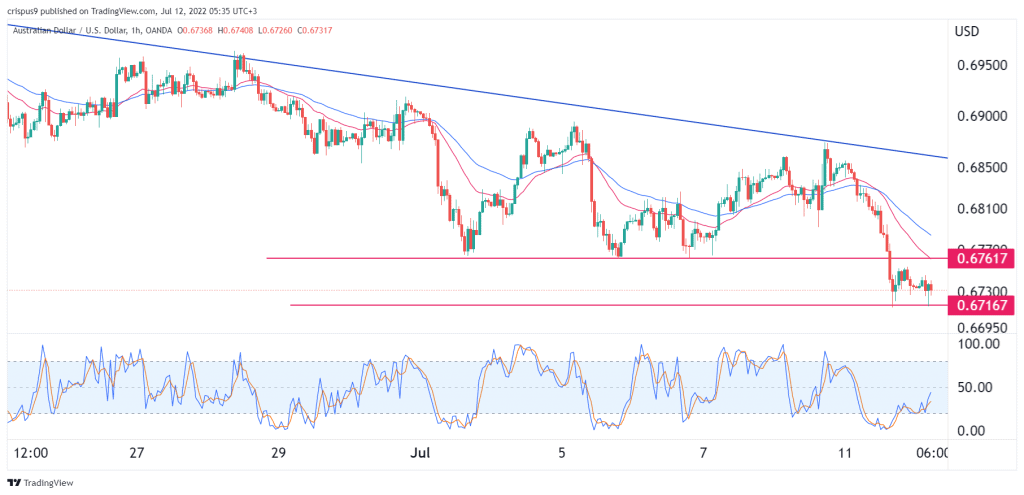

The hourly chart shows that the AUDUSD price has been in a strong sell-off in the past few days. The pair managed to cross the important support at 0.6761, which was the lowest point in June and July. It has moved below the Ichimoku cloud while the Stochastic Oscillator moved below the oversold level. The Australian dollar has formed a bearish pennant pattern.

Therefore, the bearish trend will continue in the coming days. This trend will be confirmed if the price moves below the important support point at 0.6716. If this happens, the next key level to watch will be at 0.6600. A move above the resistance at 0.6761 will invalidate the bearish view

.AUD to USD S&R levels

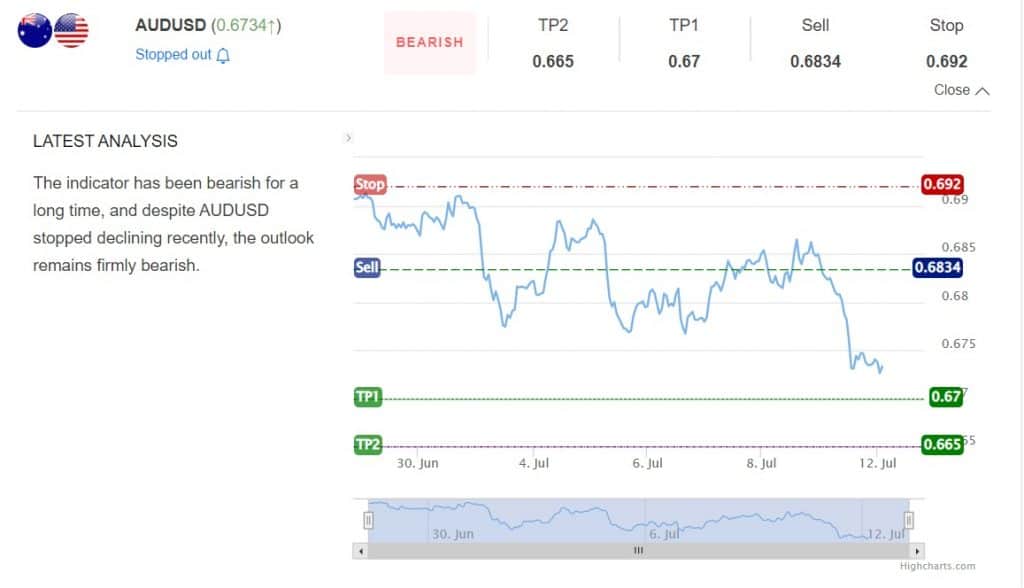

The AUD/USD pair has a bearish rating according to InvestingCube’s S&R indicator. It estimates that the pair will drop to 0.67 followed by 0.665. The stops for this view are at 0.6834 and 0.692, respectively.