- The AMC share price is trading lower, as declining momentum pulls down stock despite upbeat earnings numbers.

The AMC share price is slightly lower this Tuesday despite the the company recorded an earnings beat and an improvement in the number of moviegoers attending its theatres.

The movie operator and popular WallStreetBets stock AMC Entertainment Holdings reported Q3 2021 revenue of $755.6 million, which topped the market consensus of $708.3million. This also topped the revenue for the same period last year, which had come in at $119.5 million. The company also cut down on its losses, sustaining a loss per share of $0.44, which beat estimates of $0.53.

Attendance at its movie theatres also improved as the pandemic-induced restrictions were lifted, with 40 million moviegoers visiting its theatres compared with the 6.5 million that attended in the same period in 2020.

AMC CEO Adam Aron has attributed the improved numbers to rising vaccination counts and the company’s commitment to making its theatres safe, which has allowed moviegoers with pent-up demand to return to the theatres.

The AMC share price is trading lower on the day, losing 6.9% as of writing.

AMC Share Price Outlook

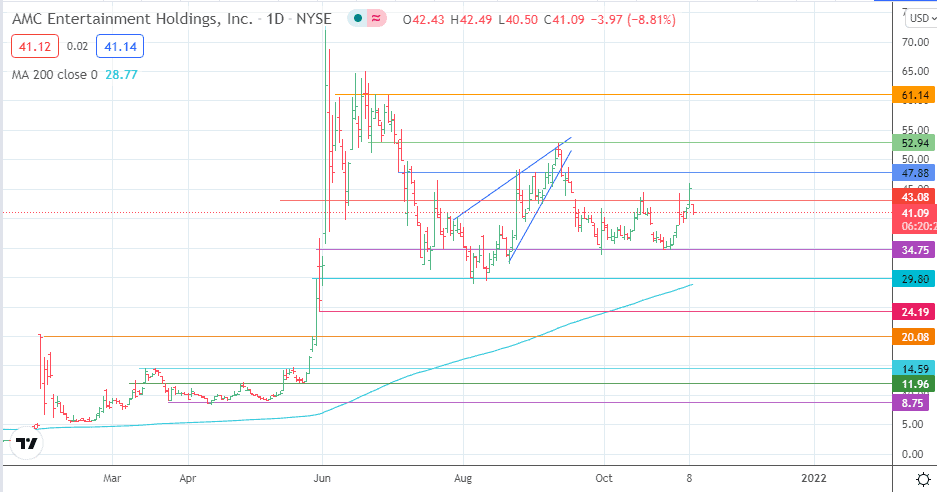

The decline comes from a rejection at the 43.08 resistance level. More bearish momentum is needed to fuel a descent towards the 34.75 support (30 September and 19 October lows). Any further declines target 29.80, after which the 200-day moving average forms a barrier between falling prices and the 24.19 support mark (28 May low).

On the flip side, a break of the 43.08 resistance opens the door towards 47.88, with 52.94 (25 June low and 13 September high) serving as an additional target to the north. If the price advance takes out this barrier, 61.14 becomes a new target for buyers.

AMC: Daily Chart

Follow Eno on Twitter.