- The AMC share price is up slightly this Tuesday, as investors recovery from the selloff of the last three trading sessions.

AMC Entertainment Holdings is slightly up on the day but remains under bearish pressure as new COVID-19 restrictions on gatherings kick in all over the world, and especially in its primary markets.

After three days of decline, the AMC share price pared some losses, but the stock remains under pressure. On Friday, both the CEO and CFO of the company sold significant portions of their stock holdings, triggering a selling spree that extended into Monday’s session.

Tuesday’s gains seem to suggest that investors have gotten over the shock of the stock sale, which exceeded expectations despite warnings from the CEO Adam Aron a few months back on this planned event. The AMC share price is up 2.84% as of writing.

AMC Share Price Outlook

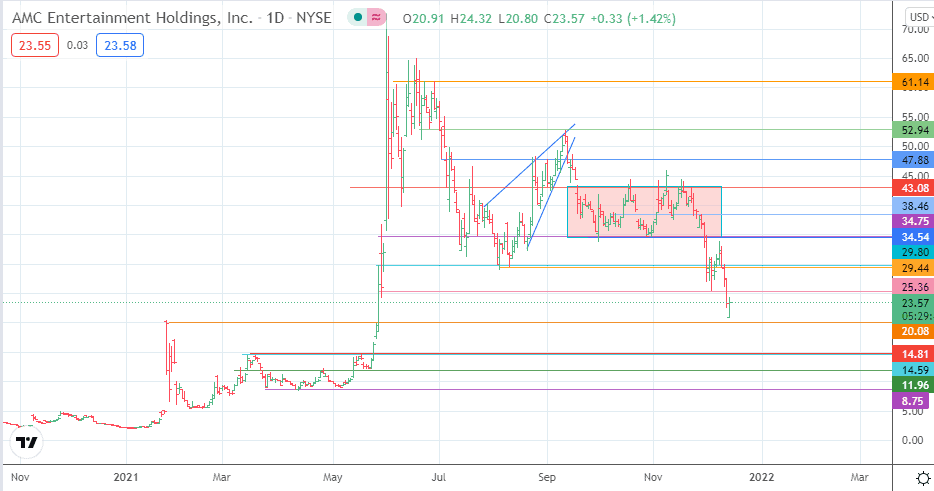

The intraday decline has violated the support at 25.36. and with the premarket price at 20.79, we could see a quick test of the 20.08 support in the Tuesday session. An extension of the decline brings the 14.81 support mark (18 March 2021 high) into the picture, leaving 11.96 as a potential downside target of note if the AMC share price declines further.

On the flip side, the bulls would be looking for a bounce that ultimately breaks sequential resistance barriers at 29.44, 29.80 and 34.54. This would put the AMC share price back into the previous range, with the ceiling at 43.08 serving as the limiting barrier before 47.88 and 52.94 become viable upside targets.

AMC: Daily Chart

Follow Eno on Twitter.