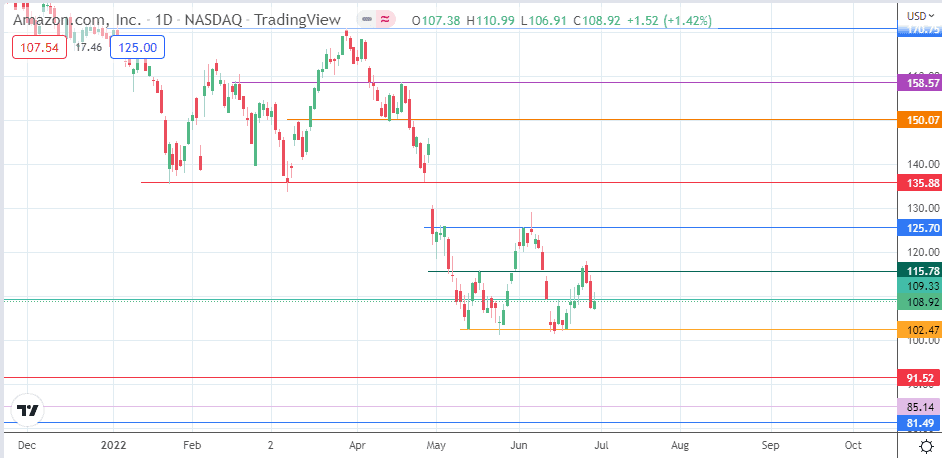

- The Amazon stock forecast for Thursday indicates that the 109.33 price level is the barrier to beat for the bulls.

The Amazon stock price gained 1.42% in Wednesday’s trading session, but the stall at a key resistance continues to dampen bullish Amazon stock forecasts. Following the stock split that issued 20 new shares for every one previous Amazon share held, the stock has had some difficulty pushing beyond its new stock split highs.

The recent price action shows that the corrective decline from the 125.70 resistance found support at the 102.47 price mark, the site of the previous double bottom. From this point, the price action formed yet another non-descript double trough pattern, with 109.33 serving as the neckline.

Clearance of this neckline enabled the bulls to push the upside move to completion at 115.78. A subsequent decline following the dark cloud cover candlestick pattern sent the price action to the 28 June low at 107.04. Going into Thursday’s trading session, the 108.92 resistance will be the key price level to beat for the bulls if a recovery in the share price is to occur.

Amazon Stock Forecast

The intraday uptick has met resistance at the 109.33 barrier, where the previous low of 10 June 2022 is found. The bulls must uncap this resistance to give them access to the 115.78 price mark, where the neckline of the 12 May/25 May 2022 double bottom is found. Above this level, the additional northbound targets are 125.70 and 135.88 (27 April low in role reversal).

The contrarian position would feed off a rejection at the 109.33 resistance, targeting the 102.47 price pivot (double bottom and 17 June 2022 low). A further decline below this price mark marks the continuation of the downtrend, targeting 91.52 (23 March 2020 low) and 85.14 (25 October 2019 low) price support levels in sequence.

Amazon: Daily Chart