Adidas stock price has been in a freefall in 2022 as business conditions worsen amid soaring inflation. The shares plunged to a low of €94.66, which was the lowest level since April 2016. It has slipped by almost 70% from its all-time high. So, is Adidas a good buy after ending its partnership with Ye?

A serial underperformer

Adidas share price has crashed by more than 60% this year as inflation and business challenges remain. It has severely underperformed the DAX index, which has fallen by more than 20%. At the same time, the shares have lagged those of Puma, ANTA Sports, and Nike. Nike shares have dropped by over 40% this year while China’s ANTA has slipped by more than 25%.

Adidas stock price has crashed as the company faces significant challenges. For one, while sport events have reopened, demand for its products has remained relatively low. The company confirmed this when it published its preliminary Q3 results last week.

Adidas said that its revenues rose by 4% on a currency-neutral basis as China’s business slowed down sharply. Excluding China, sales in other geographies jumped by double-digits. Total sales rose by 11% to €6.4 billion in Q3 while its net income dropped to €179 million. The firm’s profitability was also hindered by the company’s decision to wind down its Russian operations.

Adidas share price also crashed after it ended its partnership with Ye. The company took a charge of €250 million on its net income for the fourth quarter. Analysts believe that this decision is a major blow for Adidas, which makes more than €2 billion per year from the partnership.

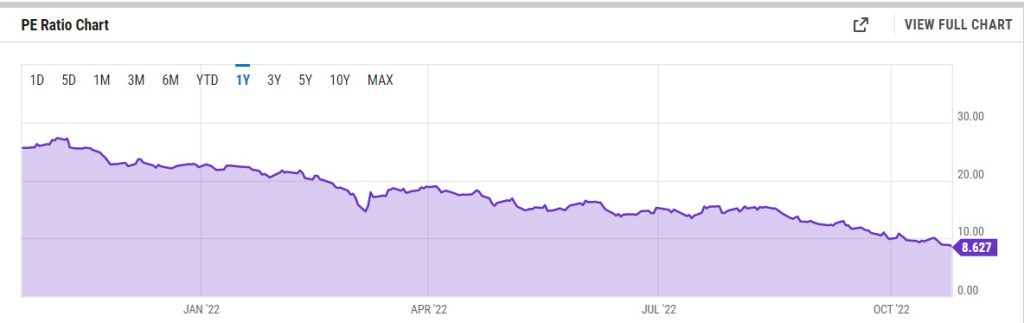

So, is Adidas a good buy-the-dip stock? Adidas faces significant challenges ahead. However, there is a sense in which the stock has become extremely cheap. It has a PE ratio of just 8.4, which is lower than its average of 41.2. Nike, its biggest competitor, has a PE multiple of 26.

Adidas stock price forecast

The daily chart shows that the Adidas stock price has been in a steep downward trend. It has crashed below the important support levels at €153.14 and €166.74. Along the way, it has crashed below all moving averages while the Relative Strength Index (RSI) has continued falling. The shares have dropped in the past 11 months straight.

The stock will likely continue falling in the near term as sentiment worsens. This could see it drop to €80. The stop-loss for this trade will be at $120. In the long term, however, the shares will likely rebound as business conditions improve.