- Tesla has started a technical correction after weeks of extremely bullish behaviour. The company started trading after its 5:1 stock split on Monday.

The Tesla share price has started a technical correction after weeks of extremely bullish behaviour. The company started trading after its 5:1 stock split on Monday and quickly announced a $5bn share sale a day later. This share sale marked the top in the price above the $500 level and after a sharp pullback, alongside other big tech names, the stock is suggesting further lows today.

The Nasdaq was off 5% yesterday amid fears that the market bubble has popped, after enthusiastic retail investors have piled into markets since the mid-March lows. It started with beaten-down stocks such as airlines before investors moved into the tech names and in recent weeks, newbie traders have been buying up call options in the big tech companies in the hopes of getting quick riches. It wasn’t only retail that were involved as market makers and big investors also had to buy calls in order to hedge risks from continued new highs.

For Tesla, a healthy correction is needed based on the company’s current valuations. The price/earnings ratio in the stock still trades at 1047x annual earnings, while even adjusted for next year’s expected results, trades at 130x. This is a far cry from value investing and even accounting for the carmaker’s strong year, it is clear that there was a “Musk Premium” on the stock. In comparison, the P/E ratio for General Motors is 28x.

Tesla has had a good year despite the coronavirus troubles at its Fairmount plant. The company saw its fourth-consecutive quarter of profit in its history and was doing well in hitting production targets. In Monday’s article, Tesla Share Price Splits as EV Competition Grows, I noted that the company is facing sales competition in Europe as the big automakers line up to take Tesla’s crown. In my closing statement, I said: “Tesla could see a correction ahead as the company’s earnings multiple has started to become expensive, while competition in Europe is building.”

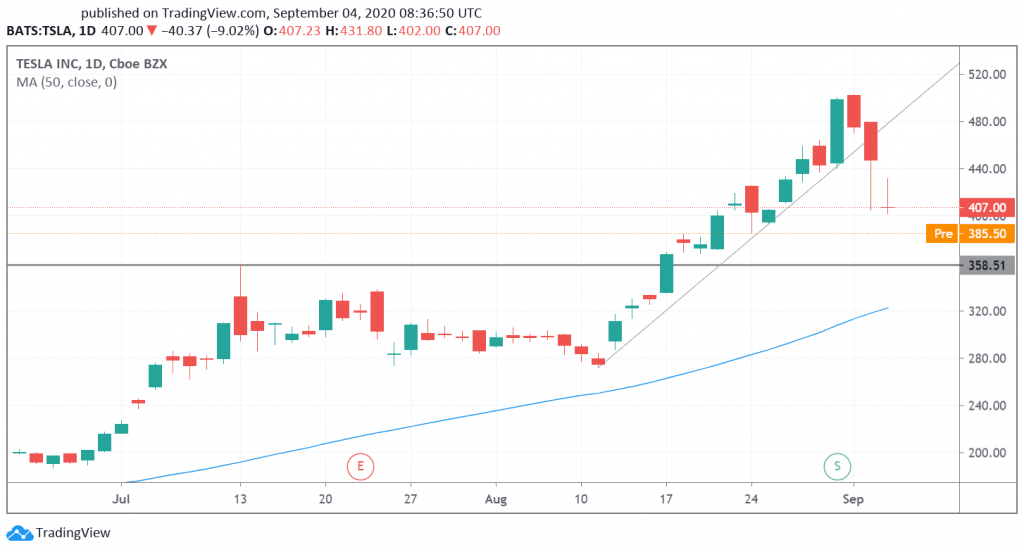

Tesla Technical Outlook

Tesla peaked with the test of the $500 level and has pulled back to break the steep uptrend line. Yesterday also saw a gap to the open and the stock is signalling further lows today. The key support is 15% lower at $358, with the 50 moving average appearing at $320. If you need assistance in timing entry and exits then consider one-to-one coaching with the Investing Cube team. More details can be found here.

Tesla Daily Chart

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.