Yes Bank share price share price opened strongly on Monday, rising to five-session highs of ₹20.60 on the back of strong quarterly results. However, it then lost momentum and slid to ₹20.14 at the time of writing, as concerns remain over its repo rate-driven margin pressure. It has traded in the ₹19.60-₹21.50 range for the most part of the last one month and the upside momentum will likely remain subdued as long as action stays confined within that bracket.

The private lender reported a 59% year-on-year rise in net profit from ₹502 crore to ₹801 crore in Q1 FY 2026, propelled by strong growth in Net Interest Income (NII), which grew by 5.1% to from ₹502 crore 2,371 crore and non-interest income which rose by about 46%. Meanwhile, net interest margin held stable at 2.5%. Also, Gross Non Performing Assets stayed stable at 1.6% and Net Non Performing Assets was at 0.3%.

While the results were a good indicator on Yes Bank (BSE: YESBANK) overall growth curve, margin dilution from repo-linked lending and mixed analyst reviews have kept investors cautious. Investors will have to assess trading volumes for clues on whether Yes Bank share price is nearing a breakout from its current range-bound position. Unless there is a significant catalyst such as regulatory policy shift of a strategic corporate announcement, the stock will likely stay in range in the near-term

Yes Bank Share Price Prediction

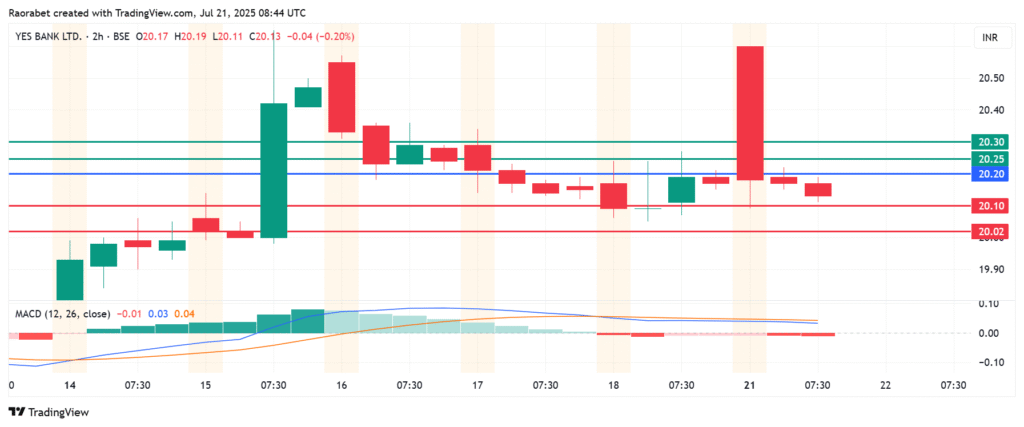

The momentum on Yes Bank share price calls for further downside if action stays below the pivot mark at ₹20.20. With the sellers in control, the downward action will likely find initial support at ₹20.10. Breaking below that level will signal a stronger momentum that could send the stock lower and potentially test ₹20.02.

Alternatively, going above ₹20.20 will signal a shift towards the upside. In that case, the first resistance will likely be at ₹20.25. Breaking above that barrier will invalidate the downside narrative. In addition, such a move could clear the path to test ₹20.30.