Ixigo share price jumped nearly 20% on Thursday, propelled by news of strong earnings. The stock hit its highest post-listing price of ₹214, with the company’s revenues having skyrocketed by about 73% year-on-year to ₹314.5 crore. In addition, net profits grew by about 28% to ₹19 crore. Growth was strong across all major segments, led by flights, buses and trains, with attributing it to strong bookings by Gen Z customers.

Notably, AI-driven efficiency was a key contributor to the growth, and the strong growth across different segments points to the scalability of its business model. At its current level, Ixigo (NSE: IXIGO) share price is about 81% above its April lows of ₹118, affirming a bullish hold of the momentum. The next major resistance will likely be at ₹220, but a sustained action above the ₹215 mark will likely build strong traction to breach that barrier.

Analysts have given the stock a favourable outlook, with JM Financials maintaining a BUY rating in its latest analysis. The emergence of new user trends improves the company’s prospects, signaling more room for growth. As per its Q1 FY 2026 results, Gen Z train bookings rose by 45%, while bus bookings grew by 123% YoY. In addition, solo female travel bookings went up by 56% during that period. These trends point to the scalability of Ixigo’s business model and favours long-term gains by its share price.

Ixigo Share Price Prediction

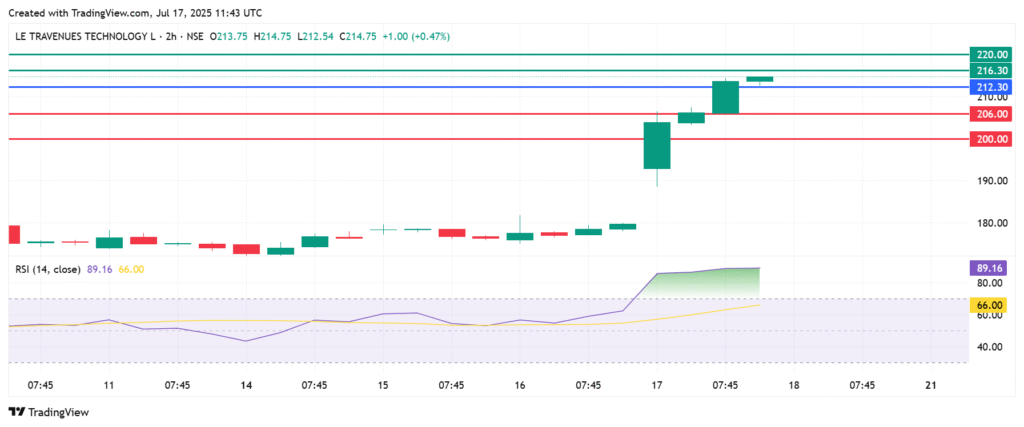

The momentum on Ixigo share price calls for further upside if action stays above ₹212.30. That will likely lead to further gains with primary resistance coming at ₹216.30. An extended control by the buyers will break above that level and test ₹220.

Alternatively, action below ₹212.30 will signal the onset of bearish control. That will likely see the first support come at ₹206. The upside narrative will be invalid if the price breaks below that level. The resulting momentum could push the action lower and test ₹200.