Gold is resilient today, hovering around $3,365 after four straight sessions in the green. The precious metal is riding a cautious wave of safe-haven demand, with investors reacting to growing geopolitical tensions sparked by Donald Trump’s latest tariff salvo.

Trump’s surprise move to impose a 30% tariff on goods from the EU and Mexico starting August 1 sent ripples through global markets. Stocks wobbled, risk appetite thinned,and gold stepped back into the spotlight.

Yet gold’s gains weren’t runaway. The US dollar flexed its muscles early in the session, climbing to its highest level since late June. That strength capped upside momentum in gold, especially with traders scaling back expectations of an imminent Fed rate cut. The central bank’s next move now hinges on key inflation prints due this week.

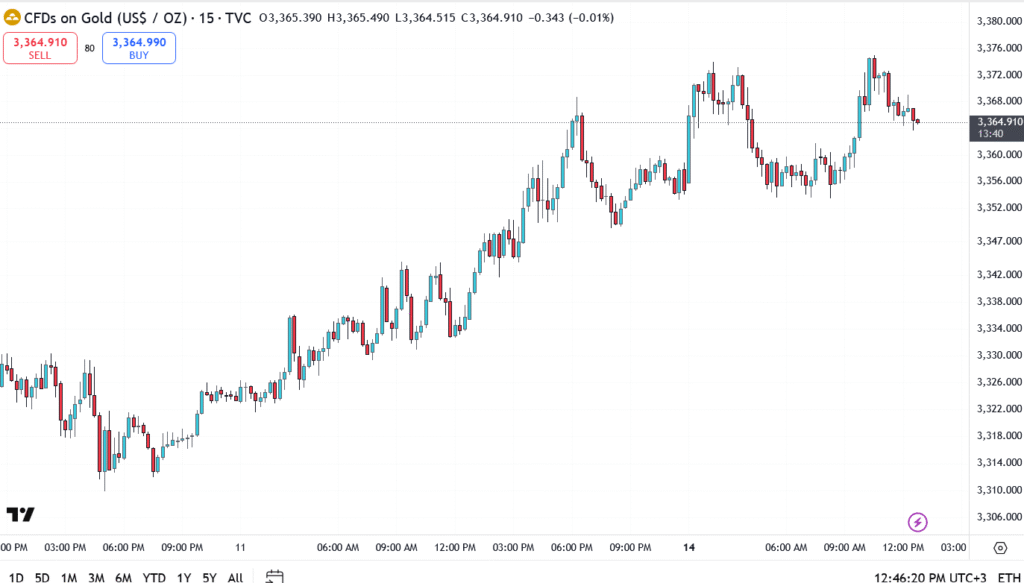

Gold Price Technical Analysis: Bulls Defend $3,360 Ahead of Inflation Data

Gold remains comfortably above its 100-period moving average, and bulls continue defending the $3,360 zone. The next target sits at $3,370, a breakout above which could put the $3,400 handle back in play. But without a fresh catalyst, the metal may continue to move sideways.

Key Levels to Watch

- Resistance: $3,370 and $3,400

- Support: $3,340, then $3,326

- Deeper support: $3,300 and $3,283

Unless US inflation data swings the pendulum, gold looks set to trade within a narrow band. For now, it’s a balancing act, between Trump’s trade war threats and the Fed’s cautious policy stance.

Gold may not be exploding higher, but it’s quietly holding its ground, and in this climate, that says a lot.