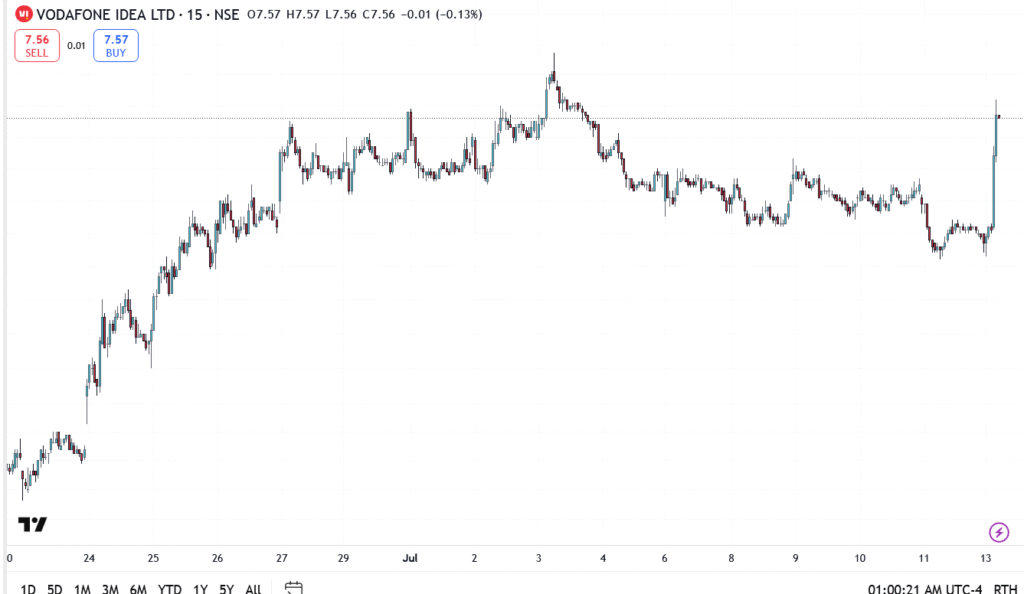

Vodafone Idea (NSE: IDEA) saw dramatic price action in early trade Monday, with shares spiking nearly 7% in the opening hour before giving up gains just as quickly. The intraday swing has left traders scrambling for clarity, especially as the move follows a sharp downgrade from UBS that rattled the sector.

IDEA traded as high as ₹18.30, up from Friday’s close of ₹17.12. But by mid-morning, the stock reversed sharply. As of 11:30 AM IST, Vodafone Idea is down over 2%.

Why Vodafone Idea Stock Is Falling Today

The pullback appears tied to UBS’s bearish call on Indian telecom stocks. On Friday, the brokerage downgraded Vodafone Idea to Sell, citing limited upside from tariff hikes and structural concerns about low-end plan pricing.

With sentiment turning cautious, Vodafone Idea’s early rally, possibly driven by retail enthusiasm or short-covering, quickly ran into resistance.

Vodafone Idea Share Price Analysis

- Price opened sharply higher, hitting an intraday high of ₹17.25, up nearly 7% from Friday’s close of ₹16.12.

- Strong resistance was observed near ₹17.20–₹17.30, where sellers stepped in, erasing early gains.

- As of mid-morning, the stock has retraced to ₹16.00–₹16.20, turning flat to negative on the day.

- Support: ₹15.75, ₹14.90

- Resistance: ₹17.30, ₹18.50

Outlook: Volatility Ahead as Tariff Debate Grows

Today’s whipsaw action underscores the uncertainty surrounding Indian telecoms. Investors are now watching whether the TRAI or DoT will intervene on tariffs, and whether Vodafone Idea can shore up its balance sheet before the next debt cycle hits.