- Unilever share price is at an inflection point as plans to spin off part of its business bring a mixed sentiment.

Unilever share price traded downwards on Friday, trading at 4,493p at the time of writing after declining by 0.7%. The stock outperformed the broader UK equities market on Thursday on the heels of a €1.5 billion share buyback program completion, which boosted investor confidence. A key catalyst for the recent movement is Unilever’s ongoing corporate reshaping, particularly the planned spin-off of its €15 billion ice-cream business.

The company has signaled its intention to choose Amsterdam as the primary listing venue for the spun-off entity, with secondary listings expected in London and New York. This move is seen as a bid to streamline operations and focus on higher-margin segments such as personal care and home hygiene.

That said, tensions have emerged between Unilever (LSE: ULVR) and Ben & Jerry’s independent board. Particularly there has been governance concerns raised over executive appointments tied to legal disputes, and that could bring a significant level of complexity into the spin-off timeline. However, Unilever share price has some support from its strong growth guidance for sales, which it estimates to come in at 3%-5% for the full year. In addition, the company’s Q2 earnings report will be out later this month and will likely inject fresh impetus.

Unilever Share Price Prediction

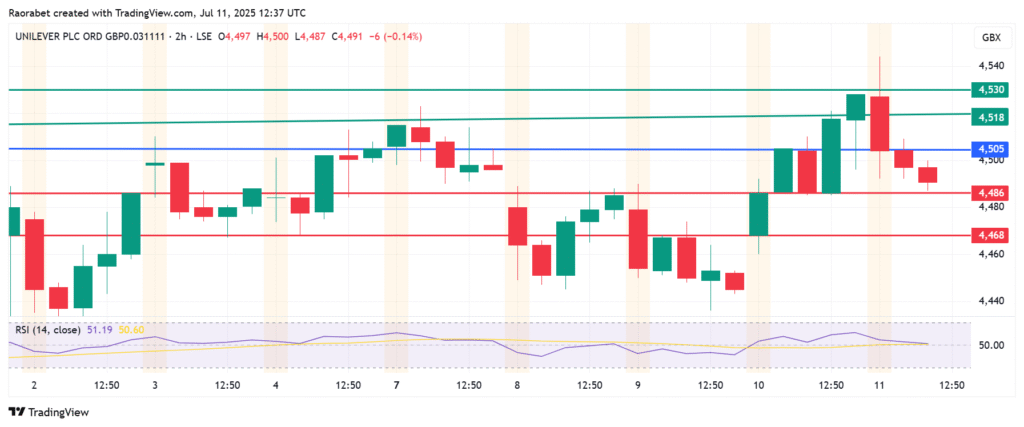

Unilever share price pivots at 4,505p and resistance at that level will keep the trajectory towards the downside. The stock will likely find initial support at 4,486p. Breaking below that level will signal a stronger momentum that could send the action lower and test 4,468p.

Conversely, breaking above 4,505p will shift the momentum to the upside. With the buyers in control, Unilever share price will likely encounter the first barrier at 4,518p. Breaking above that level will invalidate the downside. In addition, an extended control by the buyers will extend gains and potentially test 4,530p.