Sambhv Steel Tubes (NSE: SAMBHV) delivered a stellar debut on July 2, listing at ₹110 per share, a 34.15% premium over its IPO price of ₹82. The stock briefly ticked up to ₹111 but fizzled out later in the session, closing at ₹97.70. That dip, however, didn’t shake investor confidence, with the company now valued at ₹2,879 crore just two days post-listing.

The IPO itself was a crowd-puller. The IPO was a runaway success, attracting bids 28.46 times the available shares. Qualified Institutional Buyers oversubscribed their quota 62.32 times. Non-Institutional Investors had a 31.82x bid, while retail participation hit 7.99x. Beyond the numbers, what sets Sambhv apart is its rare edge, it’s one of just two Indian players using narrow-width hot-rolled coils to produce ERW steel pipes, giving it a distinct advantage in efficiency and output flexibility.

Its plant in Sarora, Chhattisgarh gives it scale, while exposure to infrastructure, automotive, agriculture, and energy sectors offers diversification most steel pipe makers can’t match.

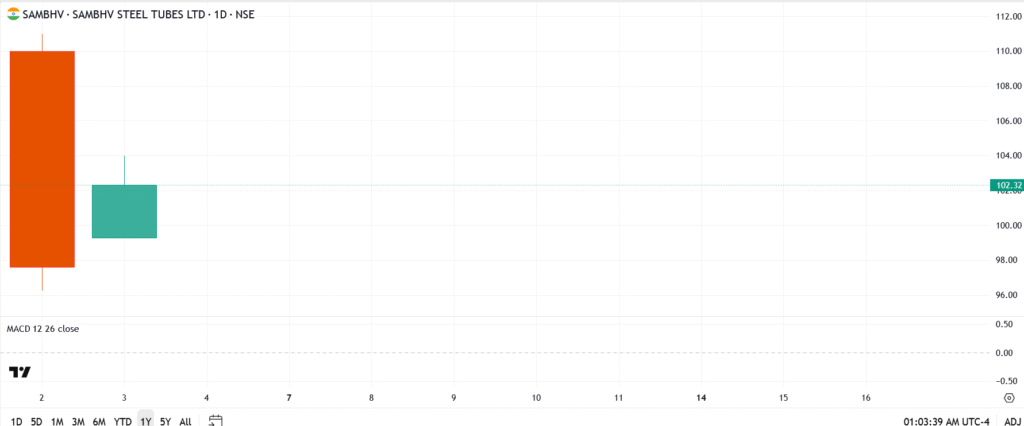

Sambhv Steel Tubes Share Price Analysis

- Current price: ₹102.32

- Resistance levels: ₹104.70, ₹110.00

- Support levels: ₹97.70, ₹94.00

A close back above ₹104.70 would put ₹110 back in sight. For now, bulls are holding the line.

This article is also available in: Polski, Nederlands, हिन्दी, Deutsch, Italiano, Español, Türkçe.