IRFC shares opened the week on the back foot, slipping to ₹133.50 in early trade before edging back toward ₹136. The stock is down around 0.5% for the day, and while that may not sound dramatic, the timing is important. Traders were watching for a breakout above ₹140. Instead, the price is stalling just below it.

This comes after a strong run in recent weeks, supported by government-led optimism in the railway sector. But with no new trigger this Monday, the momentum is clearly cooling off.

What’s Weighing on the Stock?

The company’s Q4 earnings were a mixed bag, total income came in stronger at ₹6,723 crore, but net profit slipped by 1.15%, which took some shine off the top line. Analysts aren’t aligned either. Some still see long-term upside toward ₹200, but others are pulling back sharply, warning of overvaluation.

Add to that the fact that recent announcements, like the ₹60,000 crore fundraising plan for FY26 and the ₹7,500 crore NTPC loan, have already been digested by the market, and you’ve got a stock that’s running low on fresh fuel.

IRFC Share Price Levels to Watch

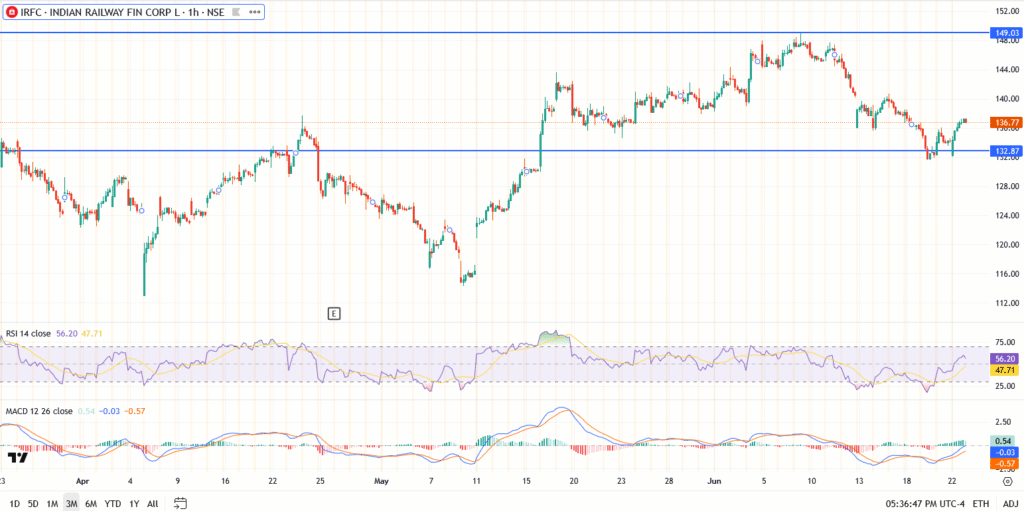

- Current price: ₹136.77

- Resistance: ₹140.00 and ₹149.00

- Support: ₹132.87, then ₹128.00

The RSI is holding at 56, not overbought, not oversold. MACD is curling up, but it’s not sending a clear bullish signal just yet. It looks like a pause, not panic.

Conclusion

This isn’t a breakdown. It’s a cooldown. IRFC remains tied to one of the government’s most aggressive infrastructure themes, and the long-term setup hasn’t changed. But short term? Traders want fresh fuel. Without it, the stock may drift between ₹132 and ₹140 before choosing a direction. Keep it on the watchlist, but wait for stronger volume before stepping in.