Gold prices in India nudged slightly higher this morning, with traders treading carefully ahead of the US Federal Reserve’s policy update expected later in the day.

Across local Indian markets, the price of gold per gram is now ₹9,420.74, a modest rise from yesterday’s ₹9,398.42. One tola of gold is fetching ₹109,881.30, showing a mild gain of around ₹260.

India Gold Price Snapshot (June 18, 2025)

- 1 gram: ₹9,420.74

- 10 grams: ₹94,207.35

- 1 tola (11.66g): ₹109,881.30

- 1 troy ounce: ₹293,017.80

Note: Prices reflect spot market averages and may vary slightly across regions and jewellers.

What’s Moving the Gold Market Today?

Right now, gold is caught in a bit of a waiting game.

The US Fed is expected to hold interest rates steady, but traders are laser-focused on what Jerome Powell says afterward. His tone and the Fed’s updated “dot plot” will likely set the tone for global risk appetite and gold’s next move.

Recent economic data from the US hasn’t helped the dollar much:

- Retail sales fell 0.9% in May, worse than expected

- Industrial production slipped 0.2%, showing further signs of a cooling economy

Meanwhile, Middle East tensions are still escalating. Iran and Israel are trading blows for a sixth day, and President Trump just escalated things by demanding Iran’s full surrender. That’s keeping gold’s safe-haven appeal alive, even if the moves are currently muted.

On top of that, Trump is turning up the heat on trade again. He told reporters tariffs targeting pharma are “coming soon,” just weeks ahead of the July 9 tariff review. That’s more fuel for gold bulls if risk sentiment sours.

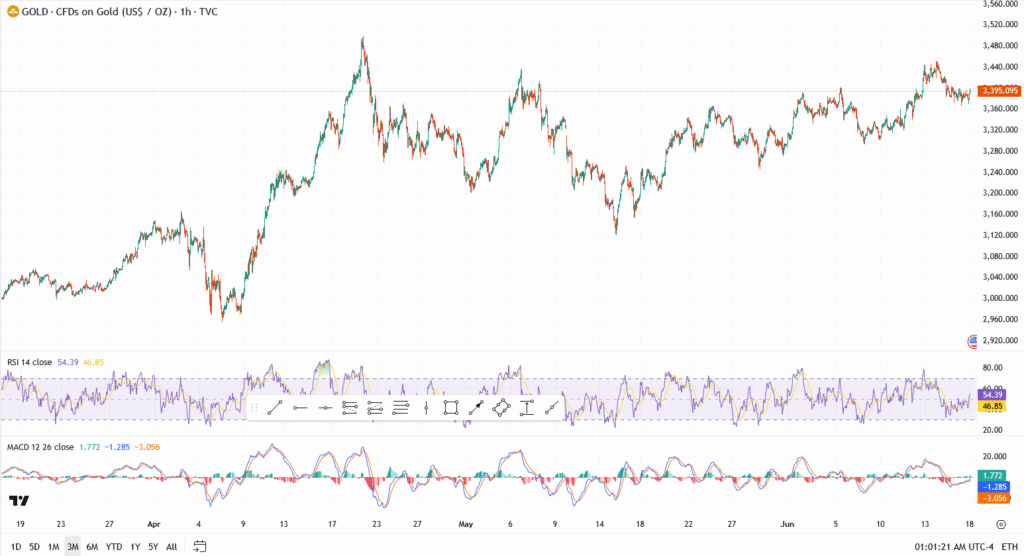

Gold Chart Analysis Today

Gold is currently hovering around ₹3,395 on the 1-hour chart, after an early June rally that lost steam near the ₹3,440 mark. The structure is now showing signs of tight consolidation, with buyers hesitant to push higher ahead of the Fed outcome.

- Immediate Resistance: ₹3,412 and ₹3,440, both recent swing highs from last week

- Support Levels: ₹3,360, followed by stronger footing at ₹3,320

- RSI: Sitting near 54, balanced, with no overbought signal

- MACD: A mild bullish crossover is forming, but the histogram remains flat

The broader tone is cautious. Gold’s recent spike has stalled, and while bulls are holding the line, they’re not in attack mode yet. A breakout above ₹3,440 could reawaken momentum, but failure to hold above ₹3,395 risks dragging price back toward ₹3,360.

In Indian pricing terms, this chart activity suggests gold spot could face resistance near ₹9,460 per gram, with ₹9,370 acting as key near-term support.

Conclusion

Gold isn’t exploding higher, but it’s firm. With the Fed meeting just hours away and Trump adding fresh volatility through both geopolitical rhetoric and tariff threats, gold remains a go-to safety net.

Indian buyers should expect slight fluctuations today, but major moves may come only after Powell speaks. Stay tuned.