As of Tuesday morning, Tata Motors (NSE: TATAMOTORS) had dropped to about ₹681 after losing almost 11.5% from its most recent swing high of ₹770. The decline follows a lower earnings estimate for FY26 from its premium division, Jaguar Land Rover (JLR), which alarmed analysts and investors.

Tata Motors Share Price Hit as JLR Slashes FY26 Margin and Cash Flow Guidance

Jaguar Land Rover has revised its financial outlook for FY26, projecting a dip in operating margins to between 5% and 7%, compared to 8.5% in the previous year. The company also expects free cash flow to shrink significantly, from £1.5 billion last year to nearly zero this year.

That’s a sharp turnaround for Tata Motors’ most critical business unit, which contributed 71% of total revenue and over 80% of overall profits in FY25. While average selling prices held firm above £70,000, the company didn’t commit to a clear timeline for recovery. Management is now eyeing improvement in margins and cash generation from FY27 onward.

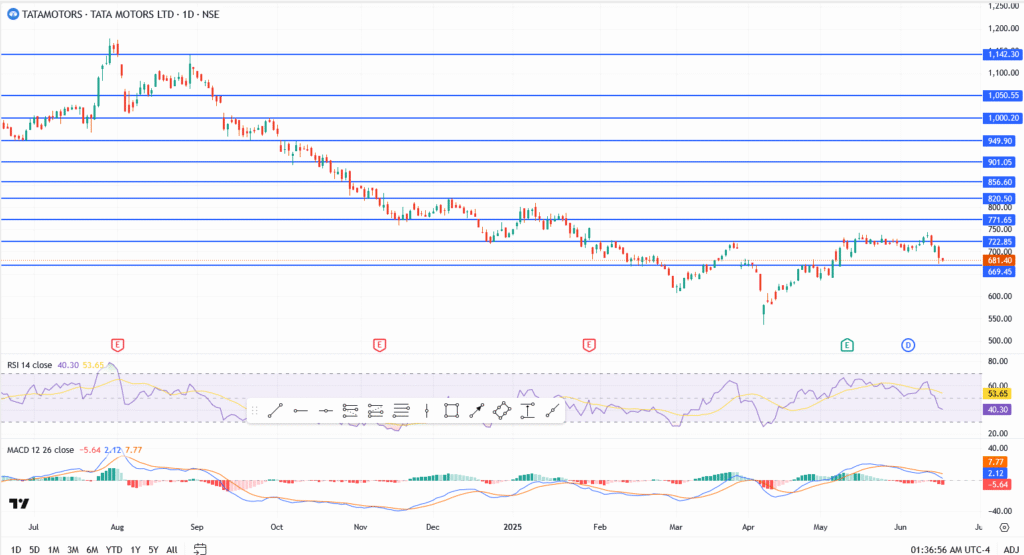

Tata Motors Share Price Analysis

- Current price: ₹681.40

- Resistance: ₹700 and ₹722

- Support zones: ₹669.45, then ₹640

What’s Next for Tata Motors Share Price?

It may be a sign of further declines if the price of Tata Motors’ stock drops below ₹669 this week. The RSI and MACD momentum indicators are still going lower, and bulls haven’t defended the ₹700 level with conviction thus far.

The stock might continue to be under pressure in the near future unless JLR provides the market with more robust guidance or fresh delivery victories. Investors are currently responding to actual issues rather than merely market noise. It would be crucial to keep an eye on ₹669 as major support.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.