- Explore how the Nifty 50 and indian markets reacted after Israel struck Iran, along with a technical outlook for the Index

The NIFTY 50 is the benchmark Indian stock market index that represents the float-weighted averages of 50 top Indian companies listed on the National Stock Exchange. Nifty 50 is owned and managed by NSE Indices, a wholly owned subsidiary of the National Stock Exchange of India.

On Friday, June 13, Israel’s military strikes on Iran deepened tensions in the oil-rich Middle East, which triggered a broad selloff across markets. Accordingly, the Indian shares declined, led by oil and gas stocks.

Market’s Reactions:

- The Nifty 50 fell 1,21% to 24,586

- BSE Sensex fell 1,2% to 80,710.56

- The domestic-focused smallcaps and midcaps slid 1.2%.

- The MSCI Asia index fell 1%, excluding Japan.

- Safe-haven: Gold and the Swiss franc gained.

- Oil prices surged 9% due to supply disruption fears.

- The oil and gas index lost 1.5%, and the energy index shed 1.3%.

- BPCL, HPCL, and Indian Oil Corp fell 3.5% (Oil marketing companies) due to rising concerns over a potential squeeze in refining margins.

- After an Air India plane crashed on Thursday in the city of Ahmedabad, the airline operators Interglobe Aviation and SpiceJet lost about 4% each.

- Israel said that it struck nuclear targets in Iran to prevent Tehran from developing atomic weapons.

- The Indian Rupee fell 0.6% vs. the US Dollar at 86.1100.

- The Indian Government bonds: the benchmark 10-year bond gets higher by 3 basis points at 6.3151%, due to high oil prices and cautious sentiments.

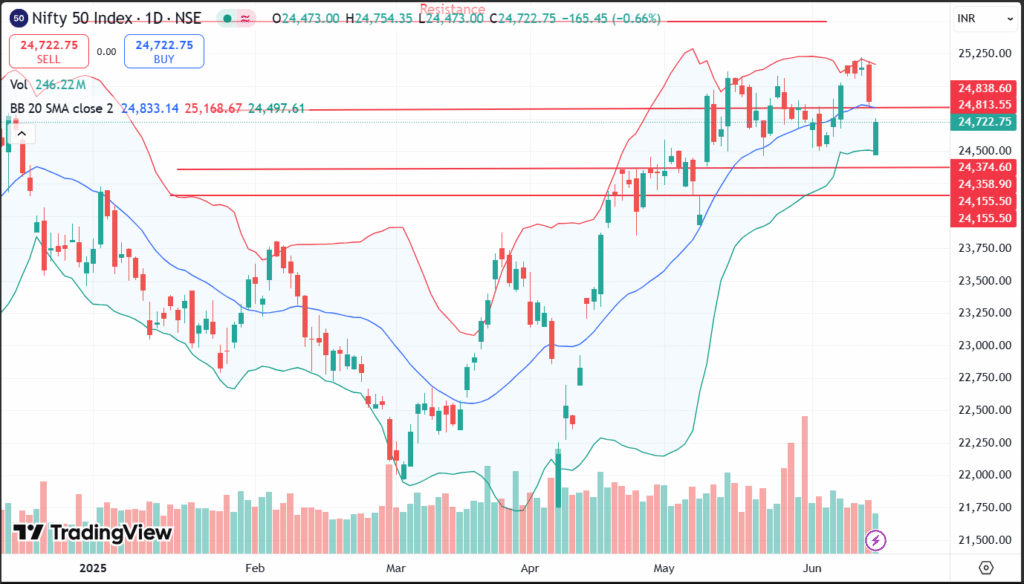

The Technical Outlook for the Nifty 50 Index:

From the technical perspective, the Nifty 50 index opened today on a gap and declined from 24,813 yesterday’s close to open around 24,472. The index remains under pressure from the geopolitical tensions between Iran and Israel.

The resistance level at 24,813 is limiting the bullish trend for the NIFTY 50, ranging between this level and the psychological support at 24,500. Any break below the 24,500 level could expose the index to lower levels towards the 24,374 and 24,155 levels. The NIFTY 50 will have high volatility and pumps due to the ongoing tensions between Israel and Iran.

Technical Levels based on Daily Time-frame:

- The Pivot Point: 24,600

- Resistance 1: 25,051

- Resistance 2: 25,330

- Resistance 3: 25,781

- Support 1: 24,149

- Support 2: 23,871

- Support 3: 23,420

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.