DocuSign (NASDAQ: DOCU) exceeded Wall Street’s forecasts for Q1 but still the company’s stock plummeted this week. The cautious full-year billings guidance and fresh worries about long-term growth momentum were the main causes of the selloff, which saw the stock fall more than 14% during Thursday’s extended trading.

The stock had closed the regular session near $92.90, not far from its recent recovery high, but quickly turned south as traders reacted to management’s updated billings outlook and signs of declining early renewals.

Strong Quarter Overshadowed by Soft Guidance

DocuSign posted adjusted earnings of $0.90 per share, easily beating analysts’ consensus of $0.83. Revenue rose 8% year-over-year to $763.7 million, also ahead of expectations. Subscription revenue led the gains, coming in at $746.2 million, but a 40% drop in professional services revenue pulled the overall picture slightly off balance.

Billings, a key forward-looking metric, rose 4% to $739.6 million, but missed the company’s own forecast range of $741 million to $751 million. That, combined with a downward revision to full-year billings guidance (now at $3.285B to $3.339B), set off alarms across the market.

Jefferies analysts downplayed the shortfall, calling it a timing issue due to fewer early renewals. But Morgan Stanley wasn’t as forgiving, cutting its DOCU stock price target from $92 to $86, citing challenges in sales productivity and lingering executive turnover.

DocuSign Chart Analysis: Bulls on Watch

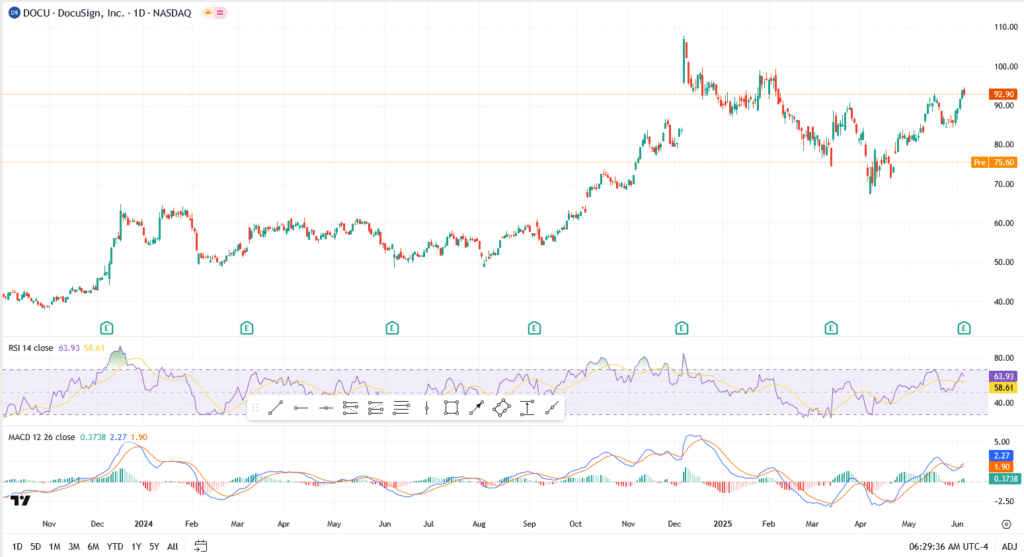

- RSI sits at 63.93, nearing overbought levels but not yet stretched, suggesting momentum is still on DOCU’s side for now

- MACD remains in bullish territory, though histogram bars are starting to shrink

- Major support is seen at $75.60, the recent low following May consolidation

- Resistance remains firm near $100, the level where sellers emerged post-earnings

Despite Friday’s post-market drop, the uptrend since April remains intact. The stock has rebounded over 23% since its March low, and technical signals still favor a retest of $100 if bulls defend current levels.

Final Take: Correction or Caution?

The decline might be less of a structural breakdown and more of a sentiment shift. Although DocuSign’s stock has done well so far this year, traders are becoming more critical as the company’s valuation continues to rise and macro worries persist.

The trend is still positive if the stock stays above $88 to $90. However, a breach below that area might restore the $75–76 support level. Anticipate volatility to persist until clarity returns.