Tesla stock fell sharply on Thursday, losing 8% in a single session, as a growing war of words between CEO Elon Musk and U.S. President Donald Trump rattled investor confidence. The public clash, which centers around disagreements on taxation and political allegiance, wiped out an estimated $150 billion in Tesla’s market value.

Shares of Tesla Inc. (NASDAQ: TSLA) dropped to $284.70, the lowest closing price in nearly three months. The decline followed a back-and-forth between Musk and Trump that began earlier this week and intensified after Musk publicly criticised the President’s “One Big Beautiful Bill”, a sweeping tax reform that was passed on party lines.

In response, Trump took to Truth Social to fire back, questioning Musk’s motives and warning that the billionaire “should be careful what he wishes for.” The post immediately triggered speculation that Tesla’s business model, which is heavily reliant on federal EV credits and U.S. government contracts, could come under political scrutiny.

$150 Billion in Market Value Erased

Tesla’s market cap fell from nearly $945 billion to just under $790 billion within hours, making it one of the biggest single-day equity losses in the company’s history. Trading volume surged, with analysts citing growing concern over Tesla’s exposure to regulatory risks under a Trump-led administration.

According to Fortune, several institutional investors have begun re-evaluating their Tesla holdings in light of the escalating feud and policy uncertainty.

Technical Breakdown Adds to the Slide

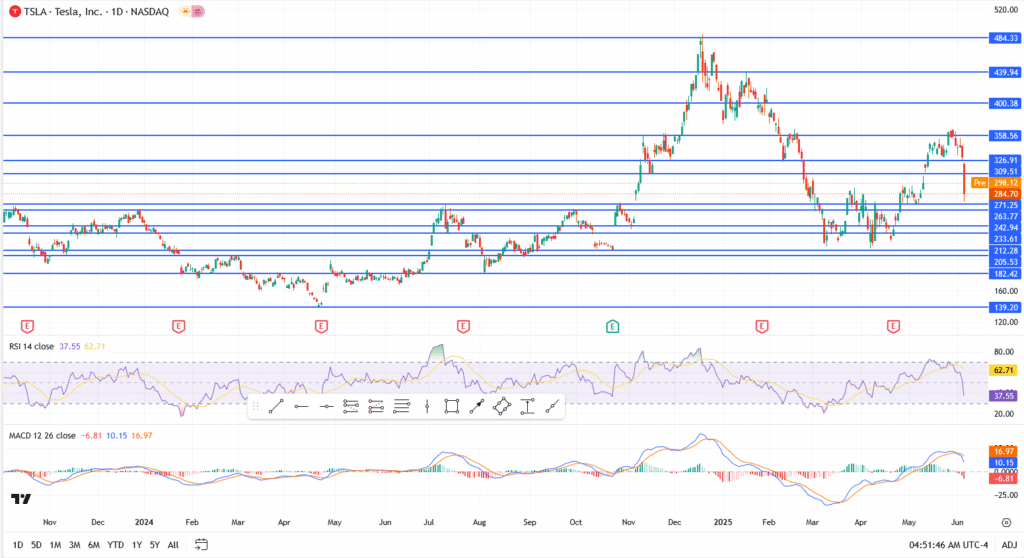

- Tesla stock broke below key support at $298

- Closed at $284.70, with next support zones at $271.25 and $263.77

- RSI dropped to 37.55, approaching oversold territory

- MACD has turned bearish, confirming short-term downward pressure

Political Risk Enters the Chat

This latest episode highlights the vulnerability of Tesla’s valuation to political headwinds. With Musk increasingly vocal on social media and Trump signalling pushback on corporate tax incentives, Tesla now finds itself in the middle of a high-stakes power struggle, one that investors can no longer ignore.

Unless the company or the White House moves to de-escalate the rhetoric, volatility is likely to persist into next week.

This article was originally published on InvestingCube.com. Republishing without permission is prohibited.