- Learn more about the main factors impact the pricing of the USD/INR and what is the technical levels for the currency pair

The indian rupee, after reaching a two-week high in the previous session, is now trading almost flat. However, the weak US dollar supports Asian currencies in gaining strength and could also provide support to the Indian currency. The decline in crude oil prices may also contribute to supporting the indian currency because India is the world’s third-largest oil consumer, so lower oil prices will have a positive impact on the INR.

Investors are waiting for the interest rate decision by the Reserve Bank of India, while they anticipate an interest rate cut in June. Additionally, the US consumer confidence report, the durable goods orders, and the Dallas Fed manufacturing index are due later on Tuesday. The market is watching for the FOMC minutes that will be released on Wednesday.

The Key Drivers for the USD/INR:

- The CME watch tool shows that the probability of cutting interest rates in June’s meeting is only 5.6% for the target rate 375-400 basis point range.

- The monetary policy of the RBI, the market anticipates that they will cut interest rates by 25 basis points in June.

The Technical Outlook for The USD/INR:

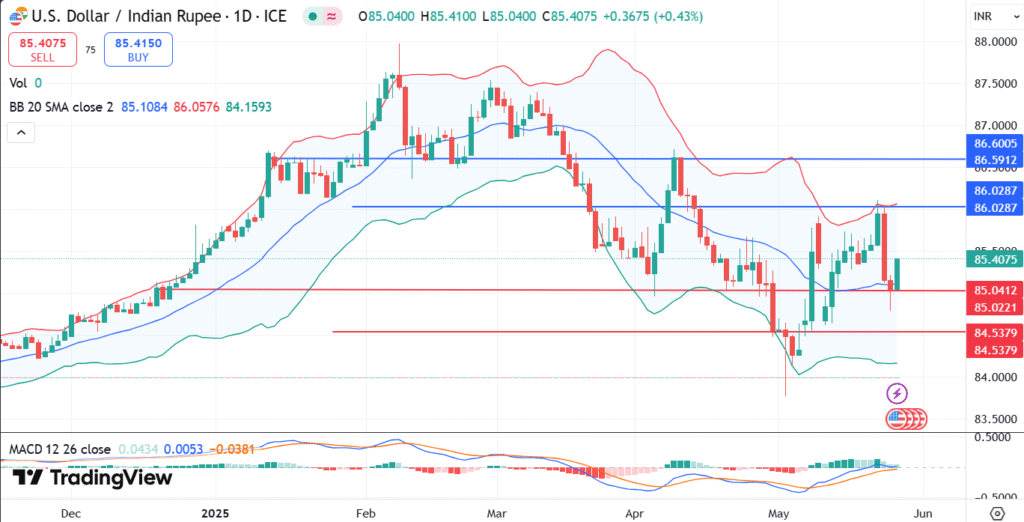

The bearish outlook remains in place for the USD/INR as the price is now trading below the resistance level of the Bollinger bands on the daily timeframe. The first support level, which is too near to the current level of trading, is 85.04; any clear break through this level will open the way to reach the second support level at 84.53 and then 84.15.

On the bullish side, the USD/INR is now trading under the pressure of a strong resistance level at 85.55. So any sustained breakout above this level could support the USD/INR to reach higher levels towards 86.02 and then 86.59. USD/INR Forecast for 2025, 2027, and 2030

What are the factors must watch by traders while trading USD/INR?

The USD/INR is sensitive to external factors such as:

- Crude oil prices because India is highly dependent on imported oil.

- US-Dollar value.

- The level of foreign investment.

The direct factors include the Reserve Bank of India’s intervention to stabilize the exchange rate as well as the interest rate.