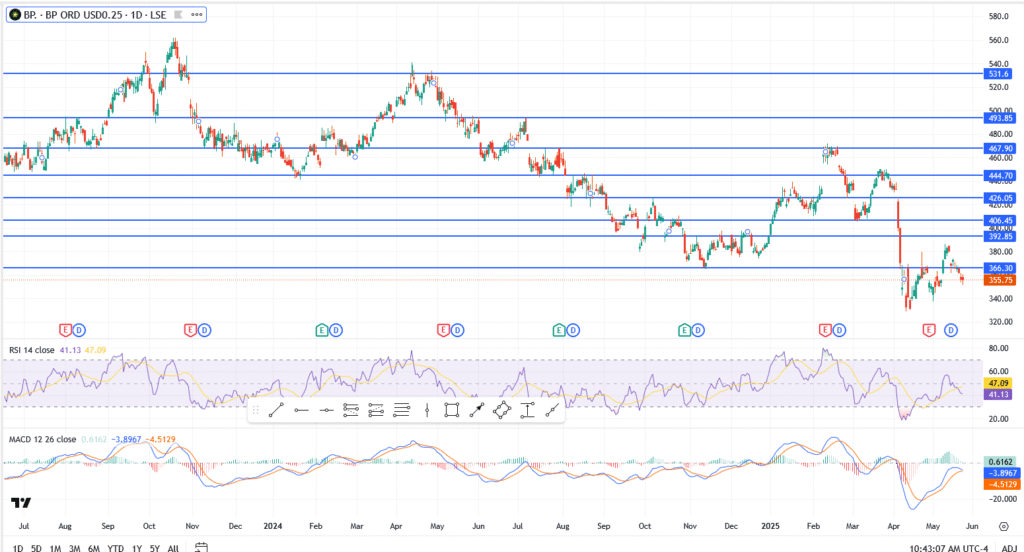

BP shares have lost steam again. After briefly snapping a six-day losing streak, the stock has dipped back toward 355p, raising fresh doubts about the strength of any near-term recovery. The bounce was short-lived, and judging by the chart, the bulls are running out of runway unless something changes fast.

Chart Breakdown: BP Faces Heavy Resistance, Weak RSI

The price structure paints a cautious picture:

- Key resistance remains locked at 366p, a level BP has failed to clear convincingly since mid-May

- Support holding at 342p, but barely – a break below here opens up room to revisit 326p

- MACD still flashing bearish, with no crossover signal yet

- RSI sits at 41.13, inching closer to oversold but not quite there – weak buying pressure

- Multiple failed attempts above 366p signal strong supply zones overhead

The momentum looks tired. Unless BP reclaims 366p and holds above it, price action could drift lower into the 340–330p zone in the coming sessions.

Traders on Edge After Brief Relief Rally

Last week’s green close had some traders hoping for a stronger rebound. But volume didn’t follow, and the stock quickly gave up gains. For now, it’s a sideways-to-lower grind, not the kind of setup that draws aggressive bids.

Options traders are keeping an eye on the 350p puts and 370p calls. A breakout above or below either strike could tilt sentiment decisively.

Part of BP’s pressure is external. With oil prices pulling back and broader energy stocks lagging, the sector is seeing less love from institutions. BP’s own fundamentals remain solid, but the market’s mood is cautious.

Unless crude oil stabilises and sector sentiment turns, it’s hard to see BP running on its own.

Outlook

The next move is binary. Hold 342p, and bulls get another shot at building a base. Break it, and 326p becomes the magnet. Momentum is clearly with the bears right now, and unless buyers show up with conviction, the downside path remains open.