Ashok Leyland share price rallied to ₹243.00 on Tuesday, gaining momentum ahead of its May 23 board meeting where the company is set to consider the Ashok Leyland bonus share issue its first in over 14 years. The move comes alongside expectations of strong Q4 FY25 earnings and a likely final dividend announcement, turning the stock into a buzzing trade this week.

The company has already announced that May 30 will be the record date to determine shareholder eligibility for the upcoming bonus shares. With that date locked in, investor positioning has accelerated, sending the stock to its highest level since October 2023.

What’s Driving the Buzz Around Ashok Leyland?

There’s more than just a bonus at stake here. For many investors, this board meeting is shaping up to be a high-stakes triple play bonus shares, earnings, and dividend.

- First, the bonus share issue is long overdue. It’s been 14 years since the company last offered one, so this feels like a reward moment.

- Second, there’s optimism building around Q4 results. The CV cycle has shown signs of strength, and analysts expect earnings to reflect that.

- Third, there’s growing chatter about a dividend. Pairing a bonus with a cash payout would likely be taken as a confident signal by the company.

And of course, the record date May 30 is already in place, which means investors don’t have long to wait or hesitate.

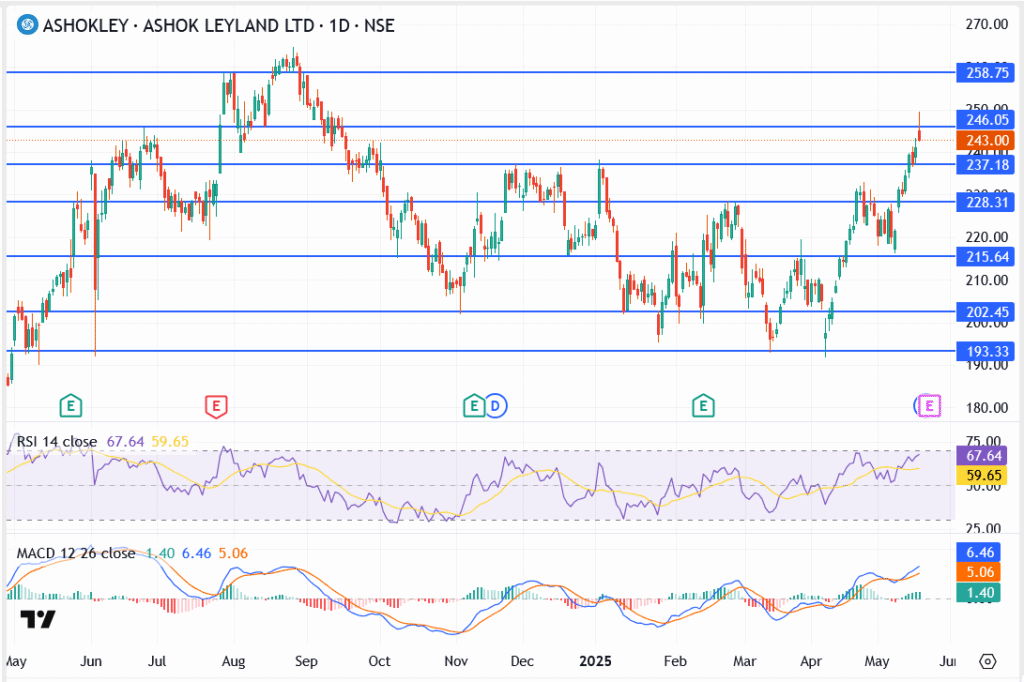

Ashok Leyland Share Price Levels: Bulls Test Key Zone

- ₹237.18 was taken out last week — a clear bullish trigger

- Price flirted with ₹243.00 today — a short-term resistance level

- The next area of interest sits at ₹246.05 — this has acted as a cap before

- Above that, the path opens toward ₹258.75 — last seen in 2023

- Momentum indicators like RSI (67.6) and MACD are still pointing up but nearing stretch levels

So far, the breakout looks healthy, but some hesitation is normal near a big announcement.

Should You Buy Before the Bonus?

That depends on what kind of investor you are. If you’re looking long-term, a bonus issue usually reflects management confidence, and that’s encouraging. But for short-term traders, it’s a tight window. There may be some volatility once the announcement is out, especially if the bonus ratio disappoints or if Q4 earnings miss.

That said, the current setup still favors the bulls unless the stock sharply reverses below ₹237.

Final Thoughts

The Ashok Leyland bonus share issue has clearly reignited interest in the stock, and with the record date already set, buyers are rushing in ahead of the May 23 decision. It’s rare to see a bonus, dividend, and earnings announcement land on the same day. Whether the stock holds up post-announcement or not, this week belongs to Ashok Leyland.