- Muthoot Finance stock dives below ₹2,120 despite 22% profit jump in Q4. Is this a buy-the-dip or a correction in India's gold loan giant?

Indian gold loan heavyweight Muthoot Finance just posted numbers that should’ve lit a fire under its stock. Q4 FY25 profit jumped 22% to ₹1,444 crore, fueled by a strong uptick in loan growth and steady rural demand. Revenue climbed to ₹3,542 crore. Sounds bullish, right?

Instead of rallying, Muthoot Finance shares dropped like a stone, erasing gains and diving below key support. For a company that beat expectations, this reaction feels oddly brutal and traders are now asking if this is a shakeout or something deeper.

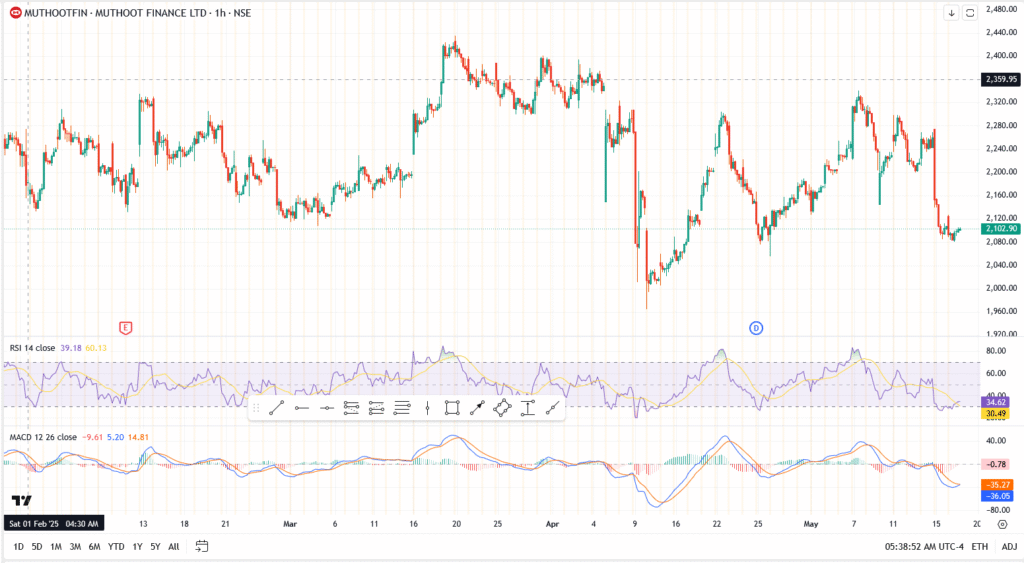

Price Action: Brutal Selloff Sends Muthoot Crashing Into Demand Zone

- MUTHOOTFIN tanked from above ₹2,280 to a low of ₹2,080

- ₹2,160 support gave way, flipping into resistance

- Current price: ₹2,102.90, hovering in a potential accumulation pocket

- RSI stuck at 39 – weak momentum, not yet oversold

- MACD flashing red – bearish crossover still in play

This isn’t just noise. The breakdown happened on heavy volume, and the chart shows a textbook flush-out.

So Why Did Muthoot Finance Stock Fall?

Here’s what’s likely going on behind the scenes:

- The earnings were already priced in. Smart money might’ve exited into strength ahead of the results.

- Gold prices are high, that’s good for collateral, but not great for loan disbursal margins.

- RBI policy overhang, with rates holding, investors fear NIMs could compress further.

- Broader financials have also cooled this week, and Muthoot simply got swept into it.

Sometimes stocks fall not because the company did poorly, but because expectations were sky-high, and the results, though solid, weren’t enough to keep up.

Should You Buy the Muthoot Finance Dip?

The ₹2,070 to ₹2,100 range is historically a sticky demand area. If bulls step in here, we could see a push back toward ₹2,160 and possibly ₹2,220. But if it breaks lower, ₹2,000 is the next line of defense.

Bottom line? The business looks strong, but the chart is bruised. Whether this dip turns into a buying opportunity depends on how quickly the stock regains momentum.